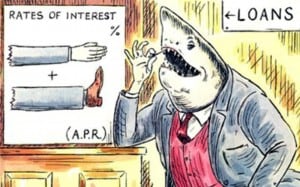

Payday loan companies continue to prey on tho se in need financially looking for guaranteed bad credit loans. We’ve devoted several blogs to warning the unsuspecting public about these unscrupulous companies but sadly people are still falling for their pitch.

se in need financially looking for guaranteed bad credit loans. We’ve devoted several blogs to warning the unsuspecting public about these unscrupulous companies but sadly people are still falling for their pitch.

Thank you for reading our Brandon's Blog. Check out our AI insolvency bot on this page and don't forget to subscribe!

- Payday Loan Companies: There are Options

- Bad Credit Loans Toronto: Legit Companies Don’t Guarantee Them

- Bad Credit Loans Online Attack the Already Vulnerable

- Payday Loan Companies Targeting You With Mobile Apps!

- Canadian Payday Loans No Credit Check: Too Good To Be True!

- Payday Loans: Ontario Cracks Down on the Cash Store

- Payday Loans are Not the Answer to Your Financial Problems

Bloomberg Businessweek recently caught up with 3 payday lenders who are living the life most of us can only dream of from their ill-begotten profits. Living carefree in St. Croix, they while away the hours on luxury yachts. Their company, Cane Bay Partners, makes millions a month in payday loans to desperate and unsuspecting people who don’t realize that they’re paying more than 600% interest a year. Bloomberg discovered that the cost for a $500 loan is $100 to $150 in interest every two weeks, according to four contracts from the websites.

Cane Bay of course denies this saying that they are a management consulting and analytics company but a former employee confirms that Cane Bay runs CashYes.com, CashJar.com, and at least four other payday loan websites. They are able to circumvent the laws because their payday loan sites use corporations that are set up in Belize and the U.S. Virgin Islands. As U.S. States and Canadian provinces crack down on payday loan companies, they’ve moved online. In fact according to John Hecht, an analyst at Jefferies Group, Internet payday lending in the U.S. has doubled since 2008, to $16 billion a year, with half made by lenders based offshore or affiliated with American Indian tribes who say state laws don’t apply to them.

Although we’ve been under the impression that most people are using payday lenders for sudden and unexpected expenses, a new report from the Consumer Financial Protection Bureau found that instead payday borrowers typically end up rolling old debts into new loans, often increasing how much they owe each time. This clearly indicates that many people are not aware of the sensible, financially sound options to dealing with debt.

Contact Ira Smith Trustee & Receiver Inc. and make an appointment today. Instead of looking for instant loans Toronto paying exorbitant interest rates at payday loan companies, we can solve your debt problems with a sound financial plan for moving forward so that Starting Over, Starting Now you can live a debt free life.