Reverse Mortgage Good Or Bad Idea

Reverse Mortgage Good Or Bad Idea: Introduction

There are certainly differing opinions on reverse mortgage good or bad idea. There’s a lot of buzz lately about seniors using a reverse mortgage to fund retirement – on television and radio commercials, articles in magazines and newspapers and on talk shows. But, how much do you really know about reverse mortgages? Most of these promotional pieces are from companies who stand to make money from your reverse mortgage.

The Ira Smith Team is here to give you impartial and balanced advice so that you can make an informed decision whether or not a reverse mortgage is right for you.

Reverse Mortgage Good Or Bad Idea: What is a reverse mortgage?

A reverse mortgage is a loan. It’s designed for home owners who are 55+ so that you can get money without having to sell your house.

Reverse Mortgage Good Or Bad Idea: How does a reverse mortgage work?

A reverse mortgage (loan) is secured by the equity (difference between the value of your home and the unpaid balance of your current mortgage). Based on the equity in your home, you can get cash. And you don’t have to make any payments. Instead of making payments, the interest on your reverse mortgage accumulates and the equity that you have in your home decreases with time. However, if you sell your house or it’s no longer is your principal residence, you must repay the loan and any interest that has accumulated.

Reverse Mortgage Good Or Bad Idea: What are the advantages of a reverse mortgage?

- You can get cash without having to sell your home

- You don’t have to make payments on your reverse mortgage

- It provides you with tax-free income

- The income from a reverse mortgage doesn’t affect Old-Age Security (OAS) or Guaranteed Income Supplement (GIS) benefits

Reverse Mortgage Good Or Bad Idea: What are the disadvantages of a reverse mortgage?

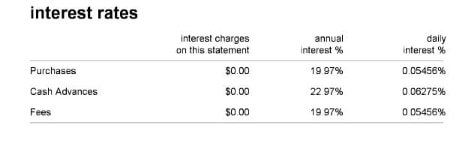

- They’re subject to higher interest rates than most other types of mortgages

- The associated costs are quite high

- The equity in your home decreases as the interest on your reverse mortgage accumulates

- At your death your estate will have to repay the loan and interest in full within a limited time

Reverse Mortgage Good Or Bad Idea: Do You Need To Refinance Debt?

As you can see, there are pros and cons to a reverse mortgage and every situation is different. If you’re considering a reverse mortgage to deal with debt contact Ira Smith Trustee & Receiver Inc. There are many ways to deal with debt. As experts we can help you make the best choice and set you on a path to debt free living Starting Over, Starting Now. Make an appointment for a free, no obligation today.