Too much personal debt: Introduction

The reality is that we live in a credit-based society. As a result almost everyone lives with debt and we don’t give it a second thought. After all, who do you know that pays for a house or a car in cash? And who doesn’t use credit cards? Having debt isn’t necessarily a problem; taking on more debt than you can repay is the problem. So how do you know that you’ve taken on too much personal debt?

Too much personal debt: What’s too much debt?

Traditional lenders (financial institutions) will typically grant you a loan based on two main criteria (there are other factors involved).

- Total Debt Servicing Ratio (TDSR): Add up all of your monthly debt payments – mortgage/rent, car payment/lease, utilities, credit cards, lines of credit, etc. If these monthly payments add up to more than 40% of your income before taxes, it’s not very likely that a traditional lender will grant you a loan.

- Gross Debt Servicing Ratio (GDSR): GDSR is your mortgage payment plus heating and taxes and it should not exceed 32% of your income before taxes. If your GDSR exceeds 32% of your income, it’s not very likely that a traditional lender will grant you a loan.

If you don’t qualify for a loan from a financial institution, you know you’ve taken on way too much debt.

Too much personal debt: Way too much debt

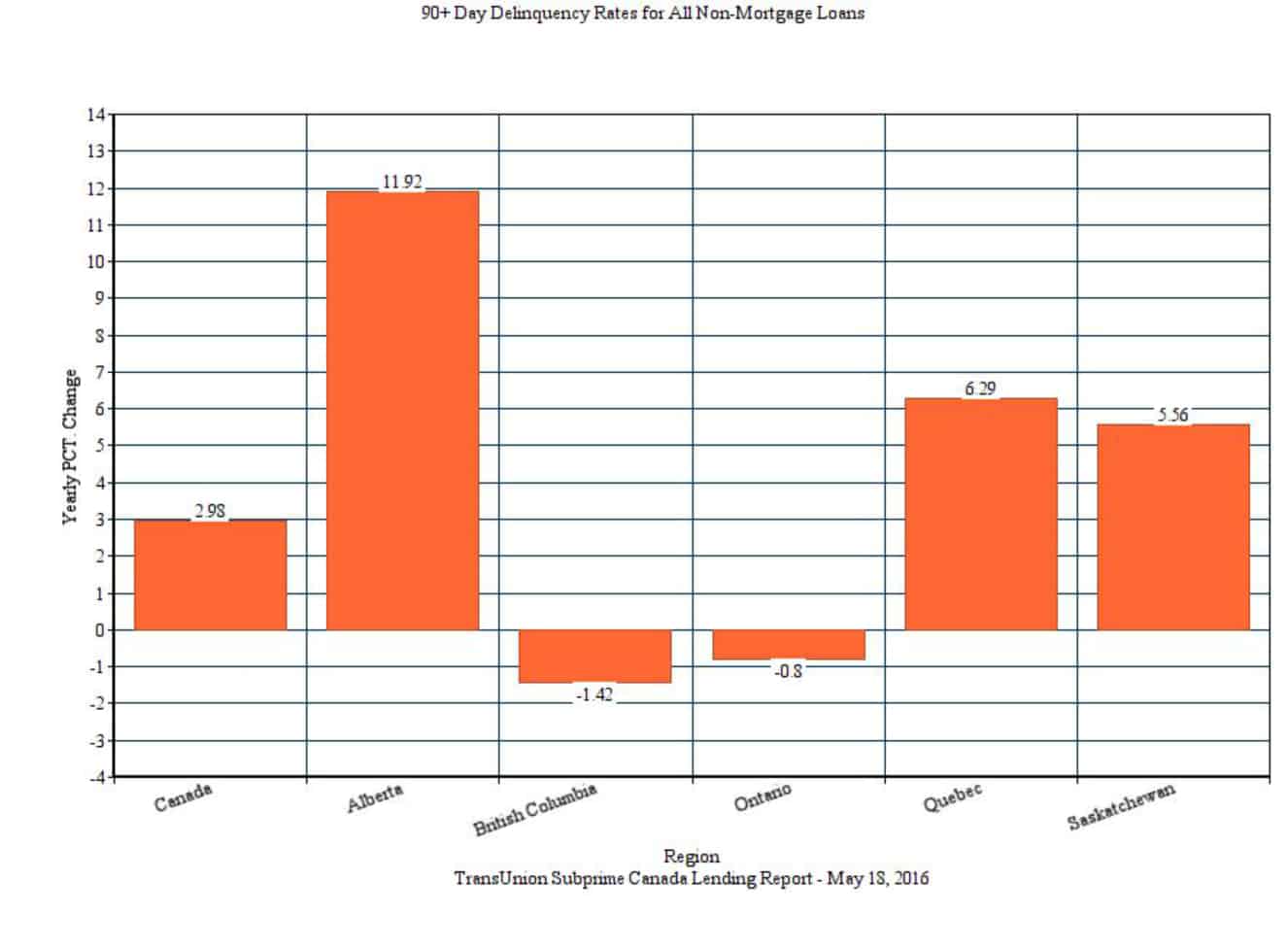

Although subprime lenders will lend money to people who don’t qualify for loans from financial institutions, their interest rates are exorbitant. Borrowing from these companies can put you into worse debt than you’re already in, so run for your life.

Other signs that you’ve taken on too much personal debt are much more obvious. Are you having trouble making your monthly payments? Are you getting calls from collection agencies? Are you living from paycheque to paycheque?

Too much personal debt: When you have too much debt

If you’ve taken on too much personal debt, get help now. Call Ira Smith Trustee & Receiver Inc. today. With immediate action and the right financial plan we can help you get back on track to debt free living Starting Over, Starting Now.

Subprime lender: Introduction

Subprime lender: Introduction