The last few weeks we’ve been discussing seniors in debt and baby boomers plagued with debt, but the sad reality is that debts are increasing in Canada across all demographics, and at alarming rates. In July 2013 we discussed how even high flyers can’t sustain the income to fund their lifestyles, so all demographics means the rich and famous included. According to the Royal Bank’s poll:

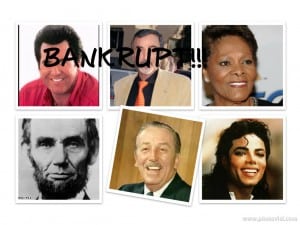

The last few weeks we’ve been discussing seniors in debt and baby boomers plagued with debt, but the sad reality is that debts are increasing in Canada across all demographics, and at alarming rates. In July 2013 we discussed how even high flyers can’t sustain the income to fund their lifestyles, so all demographics means the rich and famous included. According to the Royal Bank’s poll:

- Canadians’ debt loads have grown 21% in the past year, and more consumers are running into the red.

- For every dollar Canadians earn, they owe $1.63.

- Just 24% of Canadians say they are debt free.

- Canadians who are in debt have increased their non-mortgage burdens to $15,920. That’s an extra $2,779 over the past year compared to growth of just $83 in the year prior.

- 38% of Canadians are anxious about their debt levels.

Unfortunately Canadians are digging themselves deeper by taking advantage of low interest rates and continuing to borrow, yet wages can’t keep up leading to Canadians being anxious about their debts. As a result debt loads have skyrocketed. A new survey shows debt levels are climbing fast, to a record $1.422 trillion in the fourth quarter of 2013, according to credit agency Equifax Canada. TransUnion reported the average Canadian consumer owes $27,355 – not including mortgages. Installment loans, largely made up of car loans, were the fastest growing segment of debt, up 11% year over year. Credit card debt rose 5.9% from a year ago. It is especially true for seniors with credit card debt, as they can tap into existing credit cards to borrow where they could not longer qualify for new credit.

As Canadian sink deeper in debt, many will be living paycheque to paycheque and struggling to make the minimum payments until eventually they become insolvent. Don’t wait for disaster to strike before seeking professional help. If you are facing a debt crisis, contact a professional bankruptcy trustee as soon as possible. The earlier you seek help the more options you’ll have. Bankruptcy is not the only option for serious debt problems. There are bankruptcy alternatives including credit counselling, debt consolidation, and consumer proposals in addition to bankruptcy as solutions. Contact Ira Smith Trustee & Receiver Inc. as soon as possible and Starting Over, Starting Now you’ll be on your way to living a debt free life.