Grey divorce support groups need to show you the sticker shock!

Grey divorce support groups need to show you the sticker shock!

According to Statistics Canada, “grey divorce” has been steadily growing among those 55 and over and “gray divorce” has been growing for Americans 50 and older. Regardless of the gray vs grey spelling, the issues are the same on both sides of the border.

Canadians are struggling with debt, even those that are married and have the advantage of two incomes. However, once you separate your finances from one another and create two independent lives and lifestyles, the sticker shock sets in.

Grey divorce support groups know this only too well from their experience of counselling many who have come down this path before you. Housing is the most expensive item to fund and maintain on your own; and all of the other expenses that were essentially shared, are now the financial burden of one instead of two.

Grey divorce support groups need to teach you what Investors Group has to say

According to Investors Group:

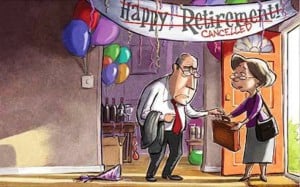

- 80% of grey divorcees (people who divorced at the age of 50 or older), say they will delay retirement because they need to work longer than planned

- 62% say their post-divorce savings and investments will no longer be adequate to fund their retirement

- 54% of those who divorced at or past the age of 50 found it difficult to make financial decisions surrounding their divorce

- 53% had to adjust their retirement plans

- 47% will have to scale back on their anticipated retirement lifestyle

- 26% no longer have enough retirement savings

Grey divorce support groups need you to understand your true income needs

As a result of grey divorce many Canadians are not only to delaying their retirement plans, they are falling into debt and dealing with it by accumulating more debt. This is a recipe for financial disaster.

Contact us today

Instead of going deeper into debt and just putting your head in the sand like an ostrich, heed the advice of your grey divorce support groups and contact us today. Seek the help from a professional trustee, even if you’re not considering bankruptcy at this stage. A trustee in bankruptcy will evaluate your situation and help you to arrive at the best possible solution for your problems, whether that solution is a bankruptcy alternative like credit counselling, debt consolidation or a consumer proposal or bankruptcy. With immediate action and the right plan the Ira Smith Team can solve your financial problems Starting Over, Starting Now. We’re just a phone call away.