Diminished car value claim: Introduction

You need to know just how car and truck manufacturers and dealerships have achieved higher sales in Canada. By forcing a diminished car value claim on you. Everything starts with pitches like this: 112 bi-weekly at 0%, reduced payments extended over a longer time period. Over half of brand-new vehicle loans are for 7 years or longer. This is a huge change from exactly what was the standard for perhaps 5 years.

Diminished car value claim: What is the best term for a car loan?

The very best time period for an auto loan, on average, is no greater than 5 years. If you are the type of person that hangs on to your car for a very long time, then you could also opt for a 7 or 8 year loan. Regardless of your choice, the key is that you have to hang on to your car for at least the length of the loan.

Letting go of your car earlier than when the loan is fully paid off, either through a forced sale, accident write-off or trade-in for a new set of wheels, will cause you to suffer the dangers of negative equity. This will produce a diminished car value claim. Continue reading below as I make the case.

Diminished car value claim: “Oh I could manage that vehicle payment”

Canadians have purchased much more pricey cars and trucks as a result of those reduced monthly payments. The typical customer sees that they believe “Oh I could manage that vehicle payment, I could handle that no worry”. For the vehicle manufacturers and dealers, it is simply an extra means of bringing customers right into the car dealership. They are marketing them something that they actually cannot pay for. It doesn’t take much to produce a diminished car value claim.

Diminished car value claim: A recipe for problems

Seven year financing, “that to me is short-sighted just a recipe for problems” says John Carmichael, Chief Executive Officer of the Ontario Motor Vehicle Industry Council (OMVIC). Salesmen ought to be discussing all the financing choices and the dangers of the financing choices and negative equity. Customers need a lot more information about a diminished car value claim. Thus people can easily get involved in a treadmill of debt.

Diminished car value claim: There is so much negative equity in a car being financed

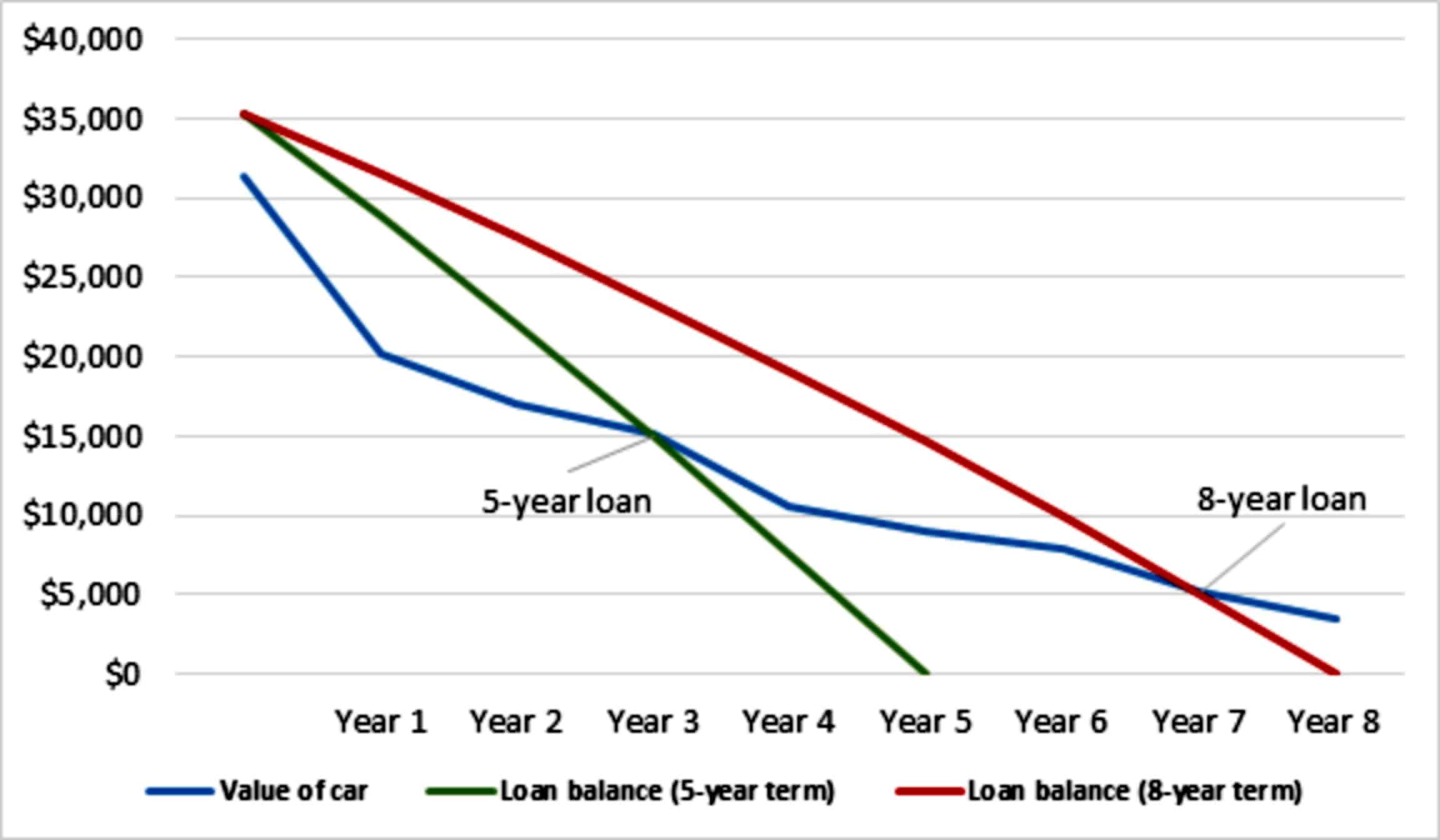

Let me show you an example of how a diminished car value claim works. Here is a negative equity comparison on a $31,300 car with a 4% interest rate.

Source: Government of Canada, Financial Consumer Agency of Canada

This chart highlights 2 vital factors:

- With five-year financing, you would not start gathering “favourable or positive equity,” until completion of the 4th year. By comparison, with an eight-year term, you would stay in an adverse or negative equity circumstance up till the 7th year of your financing.

- Negative equity has the tendency to be greater in the first 2 years of an auto loan. This is since automobiles drop rapidly in the very first year of use. Thus, a bigger section of each of your payments goes to interest in the very first couple of years.

You can find a diminished car value calculator website online. You can calculate how much negative equity you have in your vehicle for free online.

Diminished car value claim: The economic dangers of negative equity

If something unforeseen occurs and you should have to offer your auto for quick sale, you will probably lose on the loan. What you will be able to sell the car for will be less than what you owe on it. If this were to happen, you would need to have to put your hands on cash to cover your loss, i.e. the difference between the sale price and what you still owe on it.

If you are in an accident and your insurance company tells you that your car is a write-off, the cash you get from the insurer won’t cover what you still owe on your vehicle loan unless you have added insurance policy protection. Then if your insurer decides the current value of your auto is $10,000 however you still owe $16,000 on your financing, you will be required to cover the $6,000 shortage.

If your car is worth less than the amount you owe on your vehicle loan and you trade-in your vehicle at a car dealership to purchase another, you could wind up paying a great deal of extra money. You would spend for the brand-new car and have to cover the amount still owing on the old loan.

All these examples show how you could be forced to part with your car before you planned to. You will be taking on more debt because your vehicle was worth less than the amount of the loan against it. This would amount to a bigger financing and even more interest costs.

This will then snowball to produce a larger negative equity on your new vehicle because you are starting with a loan equal to more than your new car is worth. That is if you can find someone who would even lend on that basis to you. Certainly they would need more than just the new car as collateral.

Diminished car value claim: What to do if you have debt problems

Do you have debt problems, negative equity in your vehicle and zero or not enough equity in your other assets? If so, you need professional help and you need it now. More debt isn’t an answer for you. Don’t seek out a car loan debt consolidation lender.

Contact the Ira Smith Team. We can help you get out of your debt problems. We will put you back on track for debt and stress free living Starting Over, Starting Now. Book an appointment for a free, no obligation consultation today and take the first step to ending the cycle of debt.