I recently read an article on mill ennials debt that actually referred to Millennials as “The Generation of Debt”. We recently reported on this very serious problem in our blog “Gen Y Trapped: Millennials in Debt”. Pew Research reports that Millennials are more distrustful of people than ever, less likely to belong to a party or religion, more in debt, and say they are unable to marry because they lack a solid economic foundation. In addition Millennials are also the first in the modern era to have higher levels of student loan debt, poverty and unemployment, and lower levels of wealth and personal income than their two immediate predecessor generations (Gen Xers and Boomers) had at the same stage of their life cycles.

ennials debt that actually referred to Millennials as “The Generation of Debt”. We recently reported on this very serious problem in our blog “Gen Y Trapped: Millennials in Debt”. Pew Research reports that Millennials are more distrustful of people than ever, less likely to belong to a party or religion, more in debt, and say they are unable to marry because they lack a solid economic foundation. In addition Millennials are also the first in the modern era to have higher levels of student loan debt, poverty and unemployment, and lower levels of wealth and personal income than their two immediate predecessor generations (Gen Xers and Boomers) had at the same stage of their life cycles.

I found this millennials debt issue particularly interesting because just a few days ago I had a conversation with a Millennial who said that her friends felt disenfranchised and angry with the Baby Boomers who have enjoyed benefits that they expected and will never have like company defined pension plans and old age security benefits at age 65.

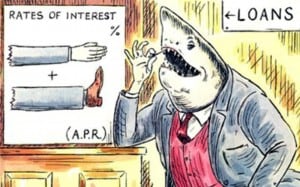

Clearly one of the major issues is that Millennials had expectations but no financial plan and many are now trapped in a debt cycle that they don’t know how to escape. Millennials debt is a problem that needs to be dealt with as soon as possible. And dealing with debt is not a DYI project. If you’re a Millennial facing serious debt issues and an uncertain financial future, contact a professional trustee. Contact Ira Smith Trustee & Receiver Inc. There are many ways to deal with debt as well as bankruptcy which include credit counselling, debt consolidation and consumer proposals.

We’re here to help. We can discuss with you the various bankruptcy alternatives for the restructuring and turnaround of millennials debt and your entire financial life leading to your overall well-being. We can put you back on the path to lead a healthy and productive life so that you can escape the millennials debt trap. Make an appointment with the Ira Smith team today so that Starting Over, Starting Now you can live a happy, productive, debt free life.