[monkeytools msnip=”http://monkeyplayr.com/playr.php?u=5173&p=20274″]

Debt help: Introduction

Canadian household debt is a problem for many Canadian families. So in this Brandon’s Blog, let’s chat about it.

There are two primary techniques for debt settlement: (1) debt stacking technique (also called the debt avalanche approach) and; (2) the debt snowball technique.

Debt help: Are you an avalanche or a snowball?

In the avalanche method, you pay off your liability with the highest rate of interest first, second highest next and so on. In the snowball technique, you pay off the single amount with the smallest outstanding balance first, second smallest second and so on.

Both techniques use, as soon as you’ve settled one, what you were paying goes to your next target balance. Avalanche can clearly conserve you cash because you are saving on interest costs. The additional amount above the minimum payment you can put towards reducing the debt goes totally against reducing the principal balance. Snowball theoretically might not save you as much with time, yet by using this technique, the quicker checkpoints wind up motivating you to place even more money against your debt.

Avalanche is more about the long haul while snowball is more about changing the way you think. When you see that you are just $60 from cleaning up one of your debts, you could select to toss that $60 right against your debt as opposed to heading out to eat.

Debt help: A real example

The best way to show this is to use an example. I will use the same set of facts and show you how the two methods would work.

Assume that you have 5 sorts of debt:

- An auto loan which has a current balance of $18,000, with a minimum monthly payment of $500 a month, at a 4.9% interest rate.

- Two student loans. One is down to $20,000. Excellent work at having it that reduced! The minimum repayment a month on that one is $300 and the interest rate is 4.6%. The 2nd student loan has a $10,000 current balance. The minimum monthly payment is $100 and is at a 5.9% interest rate.

- You bought some furniture and took advantage of a 24 month zero interest special promotion. You currently owe $7,581, the required monthly payment is $399 and you have 19 months left to go at the special promotion interest rate. Again, it is at a 0% rate of interest. If you do not pay off the balance in the next 19 months, the balance will then click away at 29% per annum.

- You only have one credit card. You owe $12,000 and it has a minimum monthly payment of $100. The annual interest rate is 19.8%.

So currently, your total debt is $67,500. Your monthly minimum repayments are a total of $1,429. At that level, it will take you about another 5 years to repay all your debt or some time in 2024 (other than for the furniture debt).

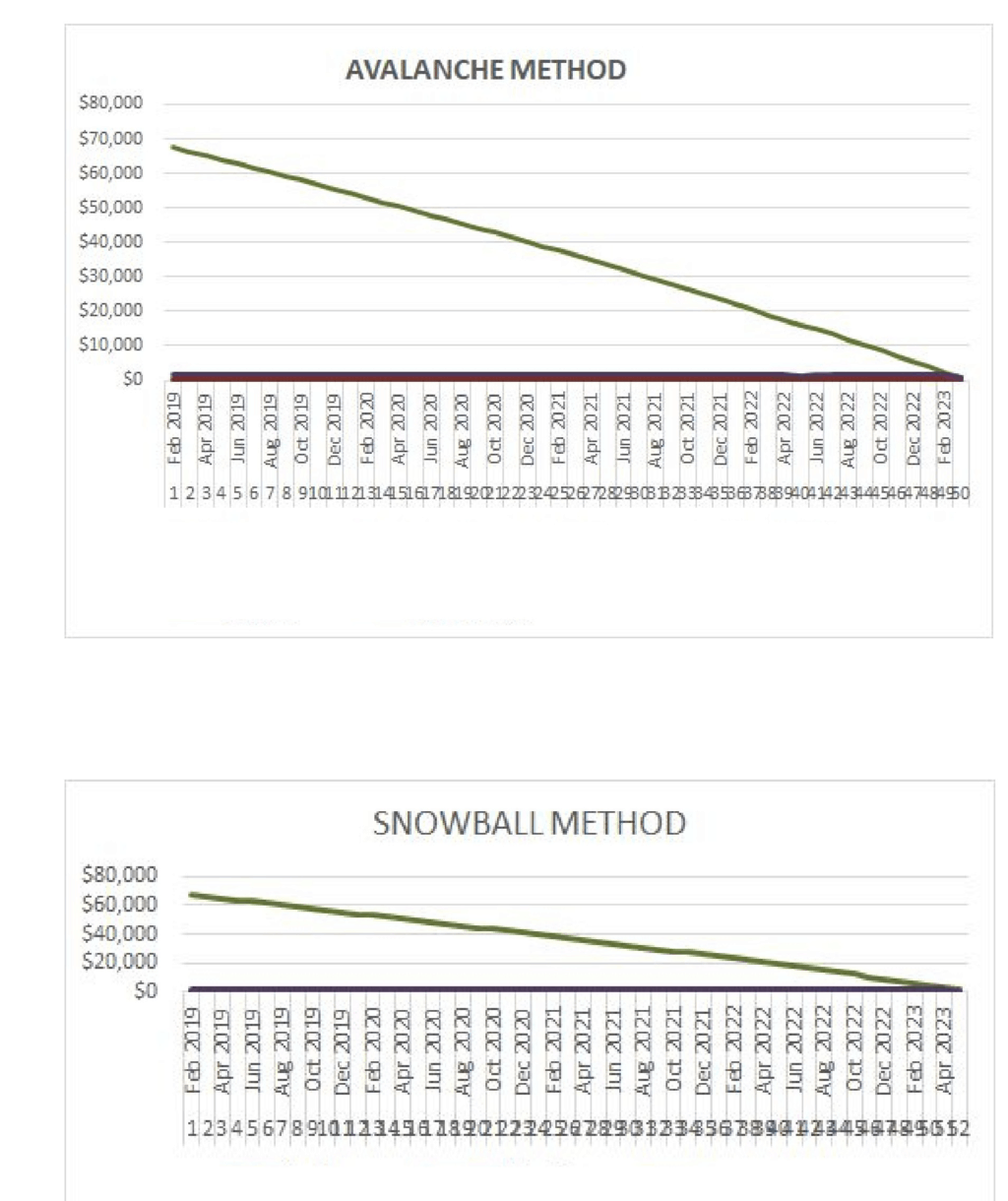

Through your budgeting, you see that you can squeeze an extra $171 out of your monthly budget to put towards your debt repayment. So overall you are paying $1,600 a month towards your debt. In the avalanche method, you will be debt free in February 2023. The interest paid throughout that time is $11,149.00.

Debt help: Repayment strategy options – Snowball vs. avalanche

Under the snowball method, you are done in April 2023. The interest paid in snowball is higher at $14,445.00. This is a difference of $3,296.00. You can certainly put those interest cost savings into your own savings plan. Also under the snowball method, it has you paying off the zero percent interest furniture loan in 13 months. The avalanche method puts the extra money against your highest interest rate credit card debt. It also lets you use the entire remaining 19 months to pay off the principal only furniture loan.

Nonetheless, both methods are valid. Under both methods, you pay off your debt a year earlier than if you did not use either of these methods and putting a bit extra against your principal. It depends what the characteristics of your debt load are. In my example, you would certainly pick the avalanche method, not the snowball method. This highlights the importance of budgeting so that you know what amount extra if any, you can squeeze from your budget towards debt repayment. Also, you can use one of the many free online calculators to figure out both the snowball and avalanche methods. That way you will know what is best for your situation.

The graphs

Let’s look at the graphs of these timelines. As you can see, the avalanche method gives you a steeper downward curve than the snowball method. Again, it is because you are paying off your debt quicker.

Budgeting and motivation

This also shows us that you have a bit more adaptability if you need to make a reduced repayment one month. Financial instability makes it difficult to toss additional money at debt. So when you’re not obtaining those incentives of getting rid of a kind of debt, it’s a little tougher to be urged. Conversely, seeing that you are chipping away at your debt will motivate you to keep refining your budget so that you can find more money to put against your debt.

The most vital thing is that you have actually developed a budget. Through the budgeting procedure, you found extra savings each month to put towards debt repayment. It’s going to take you a long time to repay your debt if you only pay the minimum monthly amount. Also, you’ll be squandering a great deal of cash on interest if you’re simply paying the minimum.

Are you caught in the debt trap?

Are you caught in the trap of too much debt and only making minimum monthly payments? Do you need debt consolidation Toronto? Are you stressed that future rates of interest increases will make presently affordable debt payments completely unreachable? Is the stress, anxiety, and pain of your debt negatively affecting your health and wellness?

If so, call the Ira Smith Team today. We have decades and generations of experience helping people and companies requiring financial restructuring. As a licensed insolvency trustee, we are the only professionals licensed and overseen by the Federal government to supply financial restructuring solutions.

Call the Ira Smith Team today to make sure that we can start assisting you. We will quickly return you right into a healthy and well-balanced stress-free life. We can create a debt settlement plan just for you to avoid bankruptcy, where we can even make the interest clock stop. This way, all your payments go only against the principal balances owing.

You can have a no-cost appointment to help you to fix your loan troubles. We recognize the pain financial debts and economic distress causes. We can end it from your life. This will absolutely allow you to start a fresh start, Starting Over Starting Now.