If you have serious financial problems, there are options in addition to bankruptcy. In fact more Canadians are now choosing consumer proposals instead of declaring personal bankruptcy due in large part to a change in the bankruptcy law that came into effect in September 2009. Previously only consumers with debt up to $75,000 could file a consumer proposal. Now the limit is $250,000. Is a consumer proposal right for you?

If you have serious financial problems, there are options in addition to bankruptcy. In fact more Canadians are now choosing consumer proposals instead of declaring personal bankruptcy due in large part to a change in the bankruptcy law that came into effect in September 2009. Previously only consumers with debt up to $75,000 could file a consumer proposal. Now the limit is $250,000. Is a consumer proposal right for you?

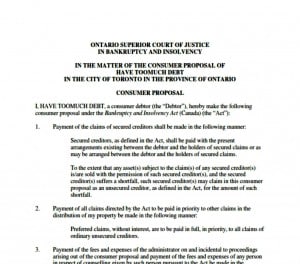

What is a consumer proposal? A consumer proposal is a way to make a deal with your creditors to repay your debts, but you can’t pick and choose the debts to be included. It’s a contract – a legally binding agreement that’s offered to your creditors through a licensed trustee, as an alternative to bankruptcy. It may be proposed that you pay a lower amount each month over a longer period of time, or pay a percentage of what you owe, and the consumer proposal must be completed within five years.

Is a consumer proposal a viable option for you? If you are an individual or a couple with total debts that does not exceed $250,000, not including debts secured by your principal residence, a consumer proposal might be the right choice for you. You will need to have cashflow from income to enable you to make your proposed payments and/or a third party able to assist you with a lump sum payment.

Why can a consumer proposal be a better option than bankruptcy? You’ll have control of your assets and more cash in hand to deal with daily expenses because a consumer proposal extends the time over which creditors are paid. Creditors like consumer proposals as well because they get more of their money repaid than if you opted for bankruptcy. However, you must be able to make the monthly payments. Your credit rating will also recover faster following the completion of a consumer proposal than from a discharge from bankruptcy. This way you consolidate all of your debts into one monthly payment that you can afford.

Be aware that a consumer proposal will not:

- Eliminate your support and alimony obligations

- Eliminate your student loan obligations if you ceased being a student less than 7 years prior to filing the consumer proposal

- Deal with your secured debts, such as your house mortgage and car loan

Only a licensed trustee in bankruptcy can act as the administrator of your consumer proposal. Go to our website for more information on consumer proposals.

Contact Ira Smith Trustee & Receiver today for a free, no obligation consultation today and take your first step toward living a debt free life Starting Over, Starting Now.