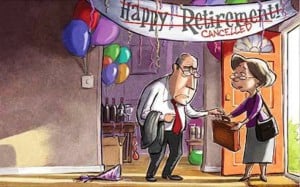

Retirement has become a hot issue with record numbers of Canadians reaching retirement age asking themselves if they will ever be able to retire. We first reported on this in a blog – Will You Ever Be Able To Retire? Many can’t afford to retire; others don’t want to. We’re living longer than previously anticipated and in many cases are outliving our incomes. According to Statistics Canada, a 65 year old man can expect to live to 83; a 65 year old woman can look forward to blowing out the candles on her 86th birthday. Moshe Milevsky, an associate professor of finance at Toronto’s Schulich School of Business at York University, says there is a 41% chance that at least one member of a 65 year old couple will live to 90. Who is going to finance this longevity?

Retirement has become a hot issue with record numbers of Canadians reaching retirement age asking themselves if they will ever be able to retire. We first reported on this in a blog – Will You Ever Be Able To Retire? Many can’t afford to retire; others don’t want to. We’re living longer than previously anticipated and in many cases are outliving our incomes. According to Statistics Canada, a 65 year old man can expect to live to 83; a 65 year old woman can look forward to blowing out the candles on her 86th birthday. Moshe Milevsky, an associate professor of finance at Toronto’s Schulich School of Business at York University, says there is a 41% chance that at least one member of a 65 year old couple will live to 90. Who is going to finance this longevity?

A new survey from ING Direct reports:

- 30% of retired Canadians have returned to work and a major reason is that they misjudged how much their expected life of ease would cost.

- The divide between how much people saved and how much they actually needed was too wide to handle without a paycheque.

- About 48% had returned to work because of financial concerns and, of these, 31% had returned to work full time.

- 33% of respondents who went back to work said they hadn’t saved enough money for retirement.

- 31% said they faced higher living costs than expected.

This indicates that a significant number of Canadians are not able to retire when they thought they should.

I came across an interesting story about an 84 year old retired factory worker who thought he was able to retire but was now trying to support 3 generations of his family (11 members) on his retirement income. How could he have foreseen that in retirement he would be called upon to help his children, grandchildren and great-grandchildren?

What happens if you are not able to retire or just don’t want to retire? What if you know that you don’t have enough saved to retire comfortably and are therefore not able to retire; or you have no idea what to do with yourself for the next 30 years? Can you be forced into retirement? This very issue was brought before the Supreme Court of Canada by John Michael McCormick, an equity partner in a national law firm who didn’t want to retire at age 65 as the partnership agreement stipulates.

CITATION: McCormick v. Fasken Martineau DuMoulin LLP, 2014

Mr. McCormick took the matter to the B.C. Human Rights Tribunal as an age discrimination in the workplace case. The Supreme Court of Canada ruled that since Mr. McCormick was an equity partner and could be part of management, he wasn’t controlled by the firm and therefore could not be subject to a Code to prevent discrimination in the workplace by those in a control position. It now begs the question, how would the Supreme Court of Canada have ruled if Mr. McCormick was not an equity partner? Would he have won his age discrimination case? What do you think? I would love to hear your take on it in the comments section below.

If you’re like many Canadians who are struggling to pay the bills, living paycheque to paycheque and can’t even say the word retirement out loud, you need help from a professional, federally licensed trustee. Ira Smith Trustee & Receiver Inc. can help get your life back on track Starting Over, Starting Now. Contact us today.