[monkeytools msnip=”https://monkeyplayr.com/playr.php?u=5173&p=21090″]

Filing for bankruptcy protection: Introduction

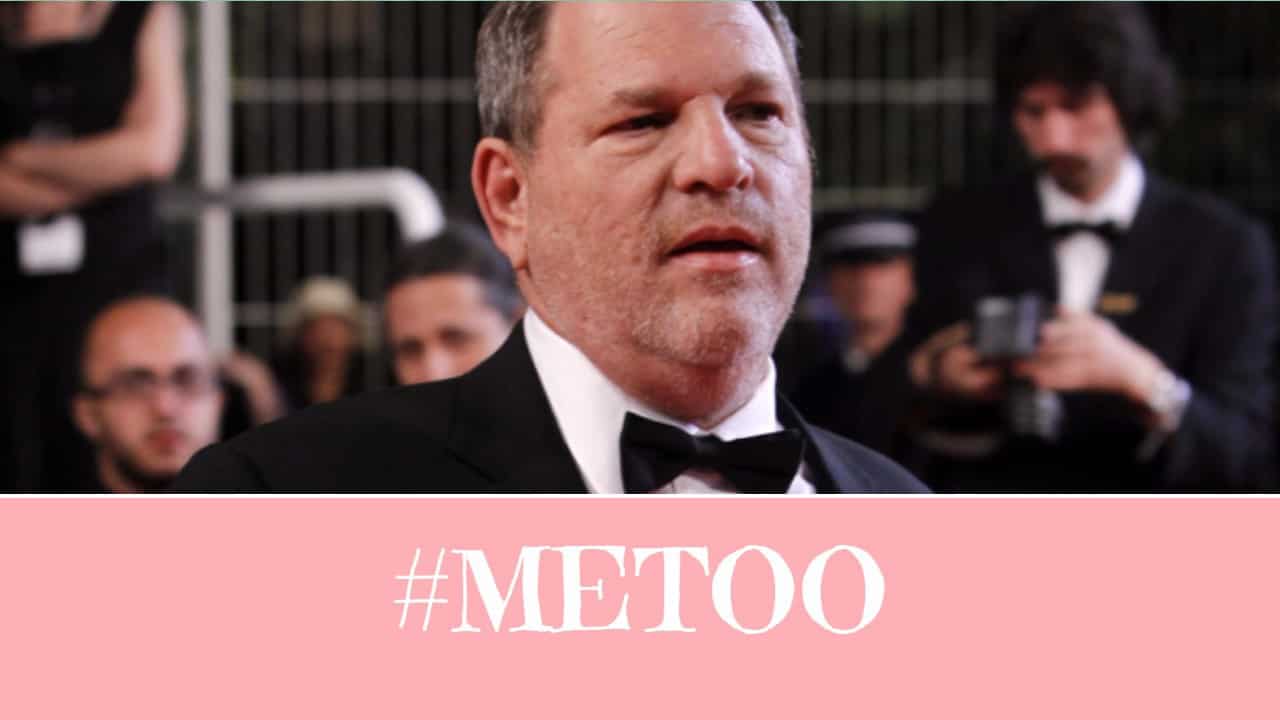

As claims against Harvey Weinstein transform from a few into an avalanche, several of the loan providers backing his named firm have actually started speaking to bankruptcy advisors about filing for bankruptcy protection, say sources knowledgeable about the issue. They are concerned that The Weinstein Company (TWC) may be filing for bankruptcy protection. Why do you ask? I will explain below.

Everyone is lawyering up

A team of The Weinstein Company’s financial institution loan providers have involved restructuring lawyers from Sidley Austin to work as advisors in case of a filing for bankruptcy protection under Chapter 11 of the United States Bankruptcy Code. They have actually likewise held pitches to work with an economic consultant to give calculated restructuring guidance.

TWC has retained the law office of O’Melveny & Myers, while Moelis & Company is acting as an economic consultant to the board. The firm has involved FTI Consulting, a financial advisory and restructuring firm.

Can The Weinstein Company borrow any more?

TWC has actually been attempting to raise money. It has also tried to offer itself totally to a brand-new financier. Talks have not yet produced a deal. Also if it locates a purchaser, a sale might have to be applied in the context of a bankruptcy, to “clean” the assets from the mounting claims against TWC.

What are its chances of a successful restructuring?

The Weinstein Company has long shot of restructuring, however, filing for bankruptcy protection would certainly provide possible purchasers with the chance to buy its movie collection and other assets free from the claims against both Harvey Weinstein and TWC.

TWC might use bankruptcy court-approved public auctions to discover purchasers and after that make use of those sale proceeds to establish a fund against which claims can be made and sorted out by the bankruptcy trustee. TWC is certainly going to meet claims over its failure to stop Harvey’s transgressions.

Is The Weinstein Company brand too toxic for it to survive?

TWC has borrowed millions of dollars in the last few years. It now faces the real possibility that its now-toxic brand name will materially influence future company chances of survival in the longer term. The cases associated with Weinstein’s alleged sex-related criminal offences will probably result in adverse annual report reporting obligations. This will further worry TWC’s lenders.

Filing for bankruptcy protection: Watch for all the lawsuits – even the ones not involving sex!

Harvey Weinstein has actually currently filed a claim against the business, looking for accessibility to his earlier company e-mail account to strengthen his defence against the sexual harassment claims against him. A bankruptcy would likely leave behind just a shadow of the firm that might really well have no choice but to file a claim against Harvey Weinstein for sinking the company. In other words, what we have here is The Weinstein Company horror movie.

Filing for bankruptcy protection: Does your company have too much debt?

Is your company insolvent and needs to restructure? Is your business viable but can only employ people and carry on business if it can restructure its debt? Contact the Ira Smith Trustee & Receiver Team. If we meet with you early on, we can create a restructuring and turnaround strategy. That way your company won’t have to be like The Weinstein Company.