How Much Interest Am I Paying Every Month?: Introduction

From my experience, how much interest am I paying every month is a question that nobody asks themselves. We’ve become a society based on credit. We have multiple credit cards, lines of credit, mortgages, car loans, student loans…

If I asked you how much interest you were paying each month I’d be willing to bet that not a single person could give me a correct answer. A monthly statement arrives either in the mail or electronically or an automatic payment comes out of your bank account or billed to your credit card. If you’re like most people the two things you see on a statement are the amount owing and the due date.

How Much Interest Am I Paying Every Month?: Start With Credit Cards

I think you’d be totally shocked at the amount of interest you’re paying each month, especially on high interest debt like credit cards. According to Capital Direct if you carry a balance of $8,000 on your credit card:

- Your statement will show a minimum payment of $240. That may not seem like a big deal but did you know that if you pay the monthly minimum each month at an interest rate of 18.9%, it will take you 4 years to pay off the debt?

- During this period you will pay $3,461 in interest charges.

- The $8,000 debt will end up costing you $11,461.

How Much Interest Am I Paying Every Month?: How You Can Find Out

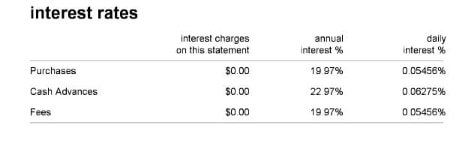

If you look at your credit card statement there will be a section that looks like this:

This is the area of your credit card statement that everyone ignores. By focusing on this area, it will allow you to calculate the amount and answer the question “how much interest do I pay every month”

How Much Interest Am I Paying Every Month?: The Bizarre Truth

According to TransUnion:

- Credit card delinquency rates jumped 14% year-over-year from 1.81% in the first quarter of 2015 to 2.06% in the first quarter of 2016.

- Subprime borrowing is up. Subprime borrowers pay a higher interest rate because they have a poor credit history.

- The average monthly balance for subprime credit card borrowers rose 5.7% to $6,601 in the first quarter.

How Much Interest Am I Paying Every Month?: What to do if you have too much high interest debt

Don’t get trapped in the cycle of high interest debt. The Ira Smith Team is here to help. With immediate action and a solid financial plan you can get escape the high interest debt cycle Starting Over, Starting Now. Give us a call today. You’ll be happy you did.

What are subprime personal loans?

What are subprime personal loans?