The Ira Smith Team is totally operational and both Ira and Brandon Smith are here for a telephone consultation, conference calls and virtual meetings.

Keep healthy and safe everybody.

If you would prefer to listen to the audio version of this Brandon’s Blog, please scroll to the bottom and click play on the podcast.

CCAA Canada introduction

We are now about 5 months into this COVID-19 pandemic since the state of emergency was announced in Canada. There has also been a lot of media coverage of the many negative effects it has had on Canadians and the Canadian economy. I thought it might be interesting at this point to do some review on CCAA Canada. Now I am not talking about the Canadian Collegiate Athletic Association. Rather, I am going to look at the companies that have so far filed for creditor protection under one of Canada’s insolvency statutes. The Companies’ Creditors Arrangement Act.

When a company tries to reorganize under CCAA Canada – What does CCAA mean?

When Canadian companies who owe more than $5 million experience financial problems, they might go to court to seek creditor protection, filing under the CCAA Canada. That’s federal legislation that primarily offers a company time to try to work out its financial troubles with those to which it owes money.

As I have written before in various Brandon’s Blogs, if the company owes less than $5 million it can file under the Part III Division I reorganization section of the Bankruptcy and Insolvency Act (Canada). Although it is the other Canadian federal insolvency statute and some procedures are more streamlined and handled slightly differently, the net effect is the same as the matters I explain below about the CCAA Canada.

What does CCAA Canada protection mean? CCAA vs Chapter 11

“Bankruptcy protection” is a term closely associated with a US company filing under Chapter 11 of the US Bankruptcy Code. That term has been adopted into the Canadian insolvency dialogue. In Canada, it most likely means that the Canadian company has applied to a Canadian court to look for protection from their creditors by filing under CCAA Canada.

A firm files under CCAA Canada for consent to come up with a restructuring plan strategy that would certainly provide it time to rearrange its financial affairs to make sure that it can keep operating.

As long as a CCAA order continues to be in place, creditors are not allowed to start or continue any kind of action to recover money owed to them. They can’t try to confiscate the firm’s property or try to petition it into bankruptcy, without the prior approval of the court. This is called the CCAA stay of proceedings.

Considering that a CCAA Canada filing is made because a business is deeply in the red, the initial order of business is to strike some kind of satisfactory arrangement with its creditors. That includes secured creditors, unsecured creditors and shareholders.

Can CCAA Canada protection be extended?

Yes, under CCAA Canada, court-ordered protection can be extended. After Algoma Steel filed under CCAA Canada in April 2001, the firm had gotten eight extensions prior to emerging with a new ownership framework.

Who gets priority under a CCAA Canada filing?

Not all creditors are treated equally. There is a priority generally established for the ranking of creditors and the order in which they might be paid by a debtor.

First in a CCAA Canada restructuring, will be any government claims that rank as a priority deemed trust claim. Next will be any new charges ordered by the court as part of the restructuring. Examples of such court-ordered security charges are Key Employee Retention Plans, financing the company needs in order to survive during the restructuring period and the costs of the professionals involved in the restructuring for the company.

Secured creditors, including lenders and bondholders, usually head the list next when it concerns getting back their money. Secured creditors might hold security such as a general security agreement and/or a mortgage as security for their debt held.

Unsecured creditors follow next on the list of creditors. Unsecured creditors have supplied goods or services on credit to the company without being given any security. In the many retailer filings that have been in the news recently, even customers who have paid deposits for items not yet picked up or who have gift cards are also unsecured creditors. Last on the list are the shareholders.

What happens if the court doesn’t approve a CCAA Canada application or the sides can’t agree on how to restructure debt?

If a restructuring effort is not successful, or if the court does not approve it, a company can be placed right into receivership or bankruptcy. The main difference between a CCAA Canada filing and the options of receivership or bankruptcy, suggests that the company can no longer be a going concern and will be liquidated.

The choice between receivership or bankruptcy depends on the nature and extent of the creditors. If there is a major secured creditor who is owed more than the assets are worth, on a failed restructuring, the court will allow that secured creditor to appoint a receiver (or the court will appoint the receiver). The receiver will then liquidate the company’s assets and repay the secured creditor as much as possible. If there are no secured creditors (which is highly unusual), or there will be money left over from the liquidation after full repayment of the secured creditors, then there will be bankruptcy. The licensed insolvency trustee acting as the bankruptcy trustee will make a distribution to the unsecured creditors.

Sometimes the type of company or industry will require both receivership and bankruptcy. Retail liquidations are a good example. The reasons are outside the main topic of discussion for this CCAA Canada Brandon’s Blog, but, one day, I will do one on that topic.

What happens to shareholders in a CCAA Canada restructuring?

Holders of common stock generally come last. On a regular basis in a CCAA Canada restructuring, they tend to get wiped out. Their old shares come to be worthless. Usually, brand-new shares are issued in the restructured company.

Holders of preferred shares rank ahead of common shareholders (for this reason the title “preferred”) yet more often than not do not get back the full value of their shares.

Public company shares in a company if it enters CCAA Canada protection and all trading is halted

When a public company announces that it has filed under CCAA Canada, a trading halt is applied. The listing exchange notifies the marketplace that trading is not taking place. While the stop is in effect, brokers are forbidden from publishing quotations or signs of interest in trading. The listing exchange will end the trading stop by taking the actions called for by its rules. Generally, the marketplace is alerted that a trading halt is about to end either at the same time the halt finishes or a few minutes before.

When a company gets on the edge of bankruptcy, its stock value mirrors the danger of a CCAA Canada administration becoming liquidation. Purely as an example, a business that used to trade at $50 might trade at $2 per share as a result of the bankruptcy environment. After entering into a CCAA Canada filing, the company’s stock price might be up to $2.10. This value is composed of the potential amount that shareholders might get after liquidation and also the possibility that the firm might restructure and run effectively in the future. Investors can buy and sell these $2.10 shares in the market. The actual value does not reach zero unless the likelihood of restructuring is so low that liquidation becomes a certainty.

While the company is in a CCAA Canada restructuring, its stock will certainly still have some value, though it will likely plummet. The regulatory authorities will watch it very closely and shut down trading if any anomalies are encountered where investors could get hurt. This was recently seen in the United States in the Hertz Chapter 11 bankruptcy protection administration.

Nonetheless, if the business restructures and emerges from CCAA Canada reorganization as a solvent going-concern, its share price might start to rise again. How much will depend on the unique restructuring issues. If a business rises from its restructuring stronger than ever, investors can take advantage of the turnaround, as old stock may get cancelled during the insolvency process, and new shares issued.

List of CCAA filings under CCAA Canada during the COVID-19 pandemic so far?

There have been many media reports about companies filing under CCAA Canada during this coronavirus pandemic. I thought it would be useful to look at which companies have filed and what industries seem to be most affected between the calling for the state of emergency and the last date for which these statistics have been published, July 31, 2020. All of this information comes from statistics published by the Office of the Superintendent of Bankruptcy Canada.

The number of companies and the industries that these companies engage in is allocated as follows:

| Cannabis | 6 |

| Charity | 1 |

| Construction | 4 |

| Energy | 4 |

| Entertainment | 1 |

| Hospitality | 1 |

| Manufacturing | 1 |

| Media | 1 |

| Mining | 2 |

| Pulp and Paper | 1 |

| Real Estate | 2 |

| Retail | 8 |

| Technology | 1 |

| Travel | 1 |

| 34 |

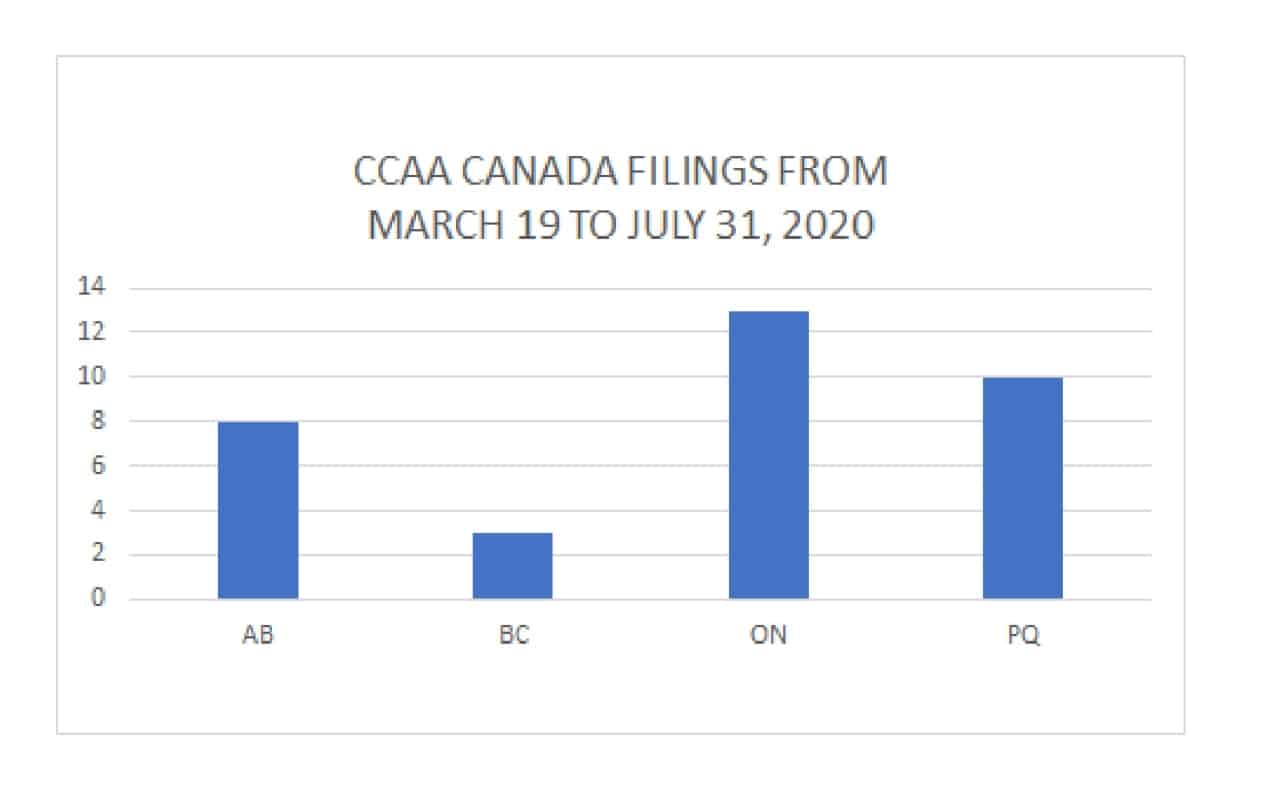

The following chart shows the filings by the province in this same time frame:

CCAA Canada summary

I hope you enjoyed this CCAA Canada Brandon’s Blog. The Ira Smith Team family hopes you and your family are staying safe, healthy and well-balanced. Our hearts go out to every person who has been affected either through inconvenience or personal family tragedy.

We are all citizens of Canada and we have to coordinate our efforts to stop the spread of the coronavirus. Social distancing and self-quarantining are sacrifices that are not optional. Family members are literally separated from each other. We look forward to the time when things can return to something close to normal and we can all be together again physically.

Ira Smith Trustee & Receiver Inc. has always employed clean and safe habits in our professional practice and continues to do so.

Revenue and cash flow shortages are critical issues facing entrepreneurs and their companies and businesses. Should you take advantage of the CEBA? I say a resounding YES!. I just wanted to highlight all of the issues that you should consider.

If anyone needs our assistance, feel confident that Ira or Brandon can still assist you. Telephone consultations and/or virtual conferences are readily available for anyone feeling the need to discuss their personal or company situation.

Are you now worried just how you or your business are going to survive? Those concerns are obviously on your mind. This pandemic situation has made everyone scared.

The Ira Smith Team understands these concerns. More significantly, we know the requirements of the business owner or the individual that has way too much financial debt. You are trying to manage these difficult financial problems and you are understandably anxious.

It is not your fault you can’t fix this problem on your own. The pandemic has thrown everyone a curveball. We have not been trained to deal with this. You have only been taught the old ways. The old ways do not work anymore. The Ira Smith Team makes use of new contemporary ways to get you out of your debt problems while avoiding bankruptcy. We can get you debt relief now.

We look at your whole circumstance and design a strategy that is as distinct as you are. We take the load off of your shoulders as part of the debt settlement strategy we will draft just for you.

We understand that people facing money problems require a lifeline. That is why we can establish a restructuring procedure for you and end the discomfort you feel.

Call us now for a no-cost consultation. We will listen to the unique issues facing you and provide you with practical and actionable ideas you can implement right away to end the pain points in your life, Starting Over, Starting Now.

The Ira Smith Team is totally operational and both Ira and Brandon Smith are here for a telephone consultation, conference calls and virtual meetings.

Keep healthy and safe everybody.

[monkeytools msnip=”https://monkeyplayr.com/playr.php?u=5173&p=22362″]