good credit score

Good Credit Score: Introduction

Have you ever received your credit score and felt a mix of anxiety and confusion? I remember sitting on my couch, staring at those three digits like they held the keys to my financial future. Well, it turns out they do!

Join me as we explore the intricate world of credit scores, unveiling unexpected truths and strategies to getting a good credit score, that can transform how you manage your finances.

Good Credit Score: The Basics – What is a Credit Score?

When I first heard about credit scores, I thought, what exactly does that number signify? A credit score is a three-digit number that reflects our financial reliability, primarily based on our borrowing and repayment history. It’s a critical piece of our financial identity that we often overlook. But let’s dive deeper into the essence of a credit score and what it truly means.

Understanding the Definition of a Credit Score

A credit score ranges from 300 to 900. This number is not just arbitrary; it comes from a credit scoring model using tried and true credit scoring formulas. The calculated number represents how trustworthy we are when it comes to handling borrowed money. Potential lenders, in turn, evaluate these scores to determine how risky it may be to give us a loan or credit. I find it fascinating how this little number can open or close doors in our financial lives.

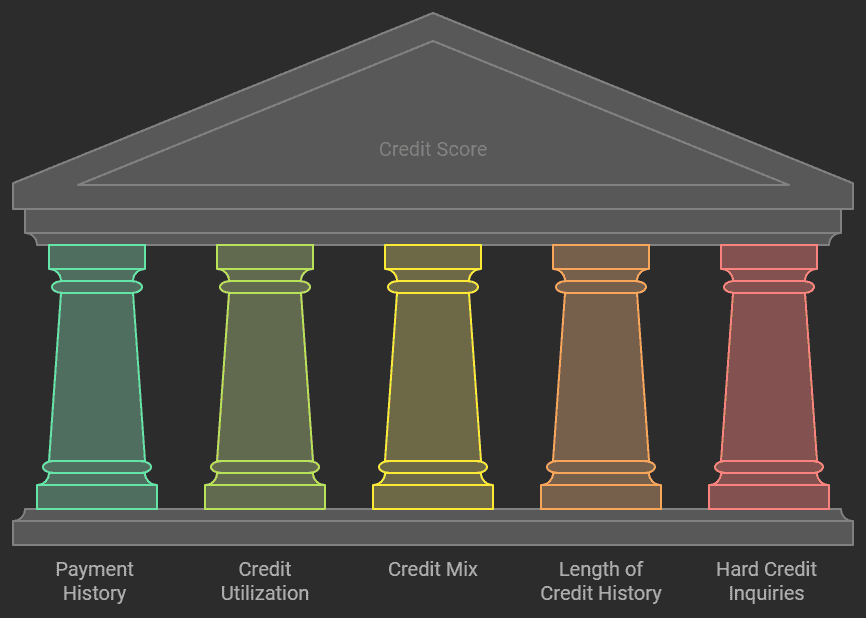

So, why is this score so important? It’s described as a financial snapshot. Think about it: if we picture our financial behaviours as a photo, our credit score is the snapshot that reveals our payment history, credit utilization rate, credit mix, length of credit history, and recent inquiries. It’s like a report card for our finances!

Factors Affecting Good Credit Scores and How It Serves as a Tool for Lenders

But how does this impact us? Well, lenders rely heavily on credit scores. They use these scores not only to judge whether we will get approved for a loan but also to decide the interest rates we might face. A good credit score often translates into lower rates. Isn’t it interesting how something we rarely think about can affect our wallets so intensely?

To further unpack this, here are the five core factors that contribute to our credit scores:

- Payment History: This is the most critical factor. Late payments are red flags, signalling a higher risk to lenders.

- Credit Utilization: This refers to how much of your available credit you’re using. Maintaining a lower utilization rate can positively impact your score.

- Credit Mix: Having a diverse portfolio of types of credit products, such as credit cards, auto loans, other personal loans, lines of credit and mortgages, shows that we can manage various forms of debt responsibly.

- Length of Credit History: This reflects how long our accounts have been active. Surprisingly, closing old accounts can shorten our credit history, potentially dragging down our score.

- Recent Inquiries: Every time we request credit, it could lower our score slightly, but multiple requests for various loans in a short time frame are grouped to minimize the impact.

Understanding these components is empowering. It’s like gaining a set of tools to improve our financial picture one day at a time.

Quotes for Inspiration

Your credit score is like a financial report card.

I couldn’t agree more. This “report card” reflects our past decisions and significantly influences our future options. Isn’t it incredible that from just one score, lenders can gauge our financial responsibility?

A Deeper Look at Good Credit Scores

As we journey through understanding credit scores, we start seeing that these numbers are more than just statistics. They represent our financial habits and choices. Small, consistent actions can lead to improvements. For instance, setting up payment reminders can help ensure we never miss a due date again.

Another lightbulb moment came to me when I learned about the strategy of becoming an authorized user on someone else’s credit card. This allows us to benefit from their positive credit history. Just like that, a simple choice can positively influence our scores.

Regularly reviewing my credit report is now a part of my routine too. We are entitled to a free credit report annually from each of our two major credit bureaus; Equifax Canada and TransUnion. This enables us to identify and dispute potential errors. This is an empowering step to ensure our scores accurately reflect our financial behaviours.

In summary, appreciating what a good credit score is and how it functions is a game changer. It transforms a source of anxiety into something we can actively manage. By choosing to understand and improve our scores, we pave the way for better financial opportunities and decisions.

The Impact of Your Credit Score on Life Decisions

Have you ever stopped to think about how much your credit score influences your life? It’s a powerful number, often lurking in the shadows of our financial choices. In reality, your credit score acts like a financial report card, detailing how reliably you manage money. And it can impact various aspects of your life in significant ways.

1. Loan Approvals and Interest Rates

Let’s talk about loans. Having a good credit score can work in your favour when you’re looking to borrow money. Lenders typically see higher scores as a sign that you’re a responsible borrower, which can increase your chances of getting approved for a loan.

Approval Chances: A higher credit score significantly boosts your chances of approval.

Interest Rates: With a good credit score, you are likely to qualify for lower interest rates, which can lead to considerable savings over time.

A better score can save you thousands throughout a loan.

So, how do you keep your credit score in good shape? The key is to make your payments on time. Think of it like taking care of a plant; if you ignore it, it won’t thrive. Late payments can damage your credit score, so it’s important to stay on top of them.

2. Impact on Renting Apartments

Next, we explore the impact of renting apartments. Many landlords perform credit checks as part of their application process. Here’s where a good credit score can make a difference.

- Application Success: A good credit score can tilt the odds in your favour when it’s time to secure the perfect apartment.

- Security Deposits: Higher scores might even lead to lower security deposits. A landlord sees you as a lower credit risk tenant.

As we navigate the rental community, we realize that

“It can influence everything from renting an apartment to even landing a job.”

Your credit score isn’t just a number; it’s a key that unlocks doors—or, in some cases, locks them shut.

3. Influence on Job Prospects

Believe it or not, your credit score can even affect your job prospects. While not all employers check credit scores, those in certain industries do. For example, financial institutions often look for a history of responsible credit management when hiring.

- Job Applications: A poor credit score could run the risk of disqualifying you from certain positions.

- Trust Factor: Employers want to know that you’re trustworthy with money—especially if you’re handling theirs.

Taking responsibility for your credit score is about more than just numbers. It’s about securing your future, whether it’s a new apartment or that job you’ve been dreaming of.

4. Other Influences

As if those factors weren’t enough, let’s talk about how your credit score can also influence your insurance premiums. Many insurance companies check your credit history. A lower score might lead to higher rates.

Ultimately, one thing is clear: a good credit score often translates to better financial opportunities. Just like a compass directing you to your destination, your credit score guides you in the right direction toward your financial goals.

In conclusion, starting to manage your credit responsibly is important. Little efforts can produce big results. So, let’s take charge—whether it’s changing payment habits or conducting a regular credit report check. Our credit scores are a reflection of our financial journey, and we have the power to shape that journey.

Decoding the Factors Affecting Credit Scores: What Goes Into Your Credit Score?

As I embarked on my journey to understand credit scores, I found myself face-to-face with a complex yet fascinating concept. Credit scores influence many aspects of our lives—from loan approvals to renting an apartment, and even landing a job. But what exactly is a credit score? Imagine it as your financial report card, reflecting how reliably you’ve borrowed and repaid money over time. This three-digit number holds the key to unlocking various financial opportunities.

The Major Components of a Credit Score

There are five essential building blocks of your credit score:

- Payment History

- Credit Utilization

- Credit Mix

- Length of Credit History

- Hard Credit Inquiries

Let’s dive deeper into these components. First up, is payment history. This is the most significant factor; it accounts for a whopping 35% of your score! It’s like the backbone of your credit score. Late or missed payments stand out vividly to lenders, waving a big red flag. As I’ve learned, “Without a doubt, it’s your payment history.” A consistent habit of on-time payments can create an aura of reliability around you.

Detailing Payment History and Its Importance

Why is payment history so crucial? Think about it this way: if you were a lender, wouldn’t you want to know how likely you are to get your money back? That’s why evaluating a borrower’s payment habits is essential. Late payments negatively affect your score; they’re like stains on a pristine shirt. It takes a lot longer to clean up that mess than to keep it clean in the first place.

So, what can you do? Establishing reminders through your bank’s online platform or using calendar alerts can be life-saving. By maintaining consistent, on-time payments, you’re crafting a positive credit history that speaks volumes about your financial responsibility.

Understanding Credit Utilization

Next, let’s focus on credit utilization. This term refers to the percentage of your available credit that you’re currently using. It’s not just about how much debt you have; it’s about the percentage of that debt to your total credit limit. Now you can see why it’s important! As I learned, “It’s about the percentage, not just the raw amount of debt.”

Maintaining a low credit utilization ratio is indicative of responsible credit management. A widely accepted guideline is to keep this percentage below 30%. For instance, if you have a credit limit of $10,000, it is advisable to maintain your balance below $3,000. This practice signals to lenders that you represent a lower risk.

Credit Utilization Calculation | Example Amount | Total Credit Limit | Utilization Ratio |

|---|---|---|---|

Current Balance | $2,500 | $10,000 | 25% |

Current Balance | $4,000 | $10,000 | 40% |

The table clearly shows that how you manage your balances can have a big impact on your credit score. Keeping your balances low is important for maintaining a good credit score over time.

Putting It All Together

Understanding the major components—payment history and credit utilization—forms a solid foundation for navigating the credit landscape. I realized that taking control of my credit score does not mean chasing perfection. Instead, small, consistent efforts can lead to immense improvements over time. Whether it’s paying your bills on time or actively managing your credit utilization, embracing these practices empowers you to take charge of your financial future.

In this journey, I’ve transformed my perception of credit scores from anxiety to empowerment. By digging deep into these factors, I’m reshaping my financial narrative. Credit scores may seem daunting, but with the right knowledge, we can navigate them confidently, building the foundation for a brighter financial future.

Strategies for Improving Your Credit Score

Improving your credit score may seem like a daunting task. However, I’ve learned that you don’t always need drastic changes to see results. Instead, it’s often about establishing simple, healthy financial habits that can produce long-lasting improvements. Let’s delve into some effective strategies that can help boost your chances of establishing a good credit score.

1. Establishing Consistent Payment Habits

One of the most critical factors to having a good credit score is your payment history. It’s like the bedrock upon which your credit score is built. Late payments? They’re big red flags to lenders. How can we ensure our payments are always on time? Setting up payment reminders can be a game-changer. Whether through your bank’s online platform or handy calendar alerts, these reminders can prevent missed due dates. Suddenly, what seemed like a chore became manageable with a few simple tweaks.

Consistency is key. I discovered that if we focus on making payments on time, we can create a positive ripple effect in our credit history. Imagine your score gradually inching up each month as you stay committed to timely payments. The quote

“Small changes can make a huge difference.”

resonates deeply here. Indeed, it’s those tiny, consistent actions that lead to substantial improvements over time.

2. Managing Credit Utilization Effectively

Next up is credit utilization. Have you ever heard that phrase before? It’s all about understanding the amount of credit we are using against our total available credit. Lenders love it when you keep your utilization low. Think of it this way: imagine you own a store, and you’ve got a massive warehouse full of goods. If you’re selling only a tiny fraction of those goods, it shows you manage your inventory well. Similarly, keeping your credit utilization below 30% can portray you as a low-risk borrower. It’s essential to monitor how much of your available credit you’re using.

- Reduce high-balance credit card accounts to improve your utilization ratio.

- Consider requesting higher credit limits, but do so wisely.

- Avoid closing old accounts, as they can help maintain a higher total available credit amount.

Managing your credit as a reflection of your financial accountability helps lenders see your reliability.

The most significant improvements often come from focusing on the fundamentals.

In this case, keeping a close eye on credit utilization certainly feels fundamental.

3. Becoming an Authorized User on a Trusted Account

Another powerful strategy involves becoming an authorized user on someone else’s credit card. Now, this isn’t just a simple favour; it’s a strategic move! By being added to a trustful individual’s account, you can inherit their positive payment history, provided the account remains in good standing.

Think of it like being an apprentice. You learn from the best and get to benefit from their experience. Be sure to communicate openly with the account holder, ensuring they maintain their end of the bargain by making timely payments—after all, their actions directly impact your credit score.

Improving your credit score does not require drastic shifts in your financial routine. Remember these essential strategies:

- Establish consistent payment habits to boost your payment history.

- Manage your credit utilization effectively to depict fiscal responsibility.

- Become an authorized user of a trusted account to benefit from positive credit behaviours.

By incorporating these strategies into your daily financial habits, you pave the way toward a robust credit profile. A strong and good credit score can enhance numerous aspects of life—from lower loan interest rates to better job opportunities.

Let’s embark on this journey toward financial strength together, understanding that every small step taken contributes to our overall success. Each decision we make brings us closer to financial empowerment.

Expert Insights For a Good Credit Score: Common Myths and Misconceptions about Credit Scores

Understanding credit scores is essential for anyone trying to manage their finances better. Many of us grow up hearing various myths and misconceptions about these three-digit numbers. But what if I told you that some of these beliefs are not true? I am passionate about debunking these myths because I’ve seen how they can lead to poor financial decisions. Let’s dive into two major misconceptions surrounding credit scores: closing old accounts and understanding hard versus soft inquiries.

1. Debunking the Myth of Closing Old Accounts

One common myth is that closing old credit accounts can simplify your finances. It sounds logical, doesn’t it? Why keep accounts you don’t use? However, closing older accounts can harm your credit score. This is because it negatively impacts your average credit age. Your credit score is influenced by several factors, and one key component is how long you’ve held your credit accounts. The longer your credit history, the better your score tends to be.

Imagine you’re building a portfolio of achievements throughout your life. Each new accomplishment adds to your reputation. Similarly, every year an account stays open and contributes to your financial history. So, ask yourself: why would you want to erase your past accomplishments?

Instead of closing old accounts, consider keeping them open—perhaps just setting them aside for emergencies. The positive impact on your credit score can be significant. Not only does it help your average credit age, but it also increases your total available credit, which can further enhance your credit utilization ratio.

“It’s all about the long game with credit.”

2. Understanding Hard Inquiries vs. Soft Inquiries

Another area clouded in credit checks confusion is the difference between hard inquiries and soft inquiries. Knowing the distinction is essential for making informed decisions about your credit. So, let’s clear up the fog.

- Soft Inquiries: These occur when you check your credit score or when companies do a background check without your permission. Soft inquiries do not impact your score.

- Hard Inquiries: These happen when a lender checks your credit report to make a lending decision. Hard inquiries typically stay on your report for about two years—however, they tend to have a minimal impact if you practice good credit habits.

Think of it this way: if checking your credit report is like glancing at the weather, a hard inquiry is more like getting caught in a storm. It has a more lasting effect, but it will pass if you take care of your credit health.

Creating a strategy for managing these inquiries is vital. I learned that if you’re shopping for a loan, it’s wise to limit hard inquiries. Most lenders will group inquiries made within a short period for the same type of loan. This means you can effectively “rate shop” without all your inquiries adding up to a detrimental effect on your score.

Good Credit Scores FAQ

- What is a credit score? A credit score is a numerical representation of your creditworthiness, reflecting your ability to repay debts and manage financial obligations. Lenders, landlords, and even potential employers may use your credit score to assess your financial responsibility.

- How does my payment history affect my credit score? Your payment history is the most crucial factor. Late payments, missed payments, collections, and bankruptcies can severely damage your credit score. It’s essential to prioritize paying bills on time to maintain a good credit history.

- What is credit utilization and why is it important? Credit utilization is the ratio of your credit card balances to your total credit limit. A high credit utilization ratio suggests you’re relying heavily on credit, which can negatively impact your score. Aim to keep your utilization below 35% for a healthy credit profile.

- Does closing old credit accounts help my credit score? Contrary to popular belief, closing old accounts can hurt your score. It shortens your credit history length and can increase your credit utilization ratio if you have outstanding balances on other cards. It’s generally best to keep old accounts open, even if you don’t use them frequently.

- What’s the difference between a hard inquiry and a soft inquiry? Hard Inquiry: Occurs when you apply for credit and the lender checks your credit report. These inquiries can slightly lower your score. Soft Inquiry: Occurs when you check your credit report or a company checks your credit for pre-approval offers. Soft inquiries don’t affect your credit score.

- How can I improve my credit score? Improving your credit score takes time and effort. Focus on consistently paying bills on time, reducing your credit card balances, and avoiding unnecessary credit applications. Regularly monitoring your credit report can help identify areas for improvement.

- Where can I access my credit report? You can obtain your credit report for free from both Equifax and TransUnion, Canada’s two national credit bureaus. Review your report for any inaccuracies and dispute any errors to ensure the information is up-to-date and correct.

- What are the key factors influencing my credit score? Five main factors determine your credit score:

- Payment History: Paying bills on time demonstrates responsible credit management and significantly impacts your score.

- Credit Mix: Having a variety of credit accounts (e.g., credit cards, loans) shows you can handle different types of credit responsibly.

- Credit Utilisation: This refers to the percentage of your available credit you’re currently using. Keeping it below 35% is recommended.

- Credit History Length: A longer credit history generally reflects greater financial experience and can positively impact your score.

- Credit Inquiries: Applying for new credit results in inquiries on your report. Too many inquiries in a short period can lower your score.

Good Credit Score Final Thoughts

In summary, many misconceptions about credit scores can easily mislead us. Closing old accounts to simplify finances is counterproductive and can negatively affect our average credit age. Likewise, understanding the nuances between hard and soft inquiries is crucial for informed decision-making. These misunderstandings often leave people feeling lost in a sea of financial uncertainty.

Education is key. By understanding these aspects, you can take proactive steps to manage your credit wisely. I now realize that small, consistent efforts can lead to significant improvements in my credit score. It’s empowering to know that I have control over my financial future, and that’s a lesson I think everyone should embrace!

I hope you enjoyed this good credit score Brandon’s Blog. Do you or your company have too much debt? Are you or your company in need of financial restructuring due to distressed real estate or other reasons? The financial restructuring process is complex. The Ira Smith Team understands how to do a complex restructuring. However, more importantly, we understand the needs of the entrepreneur or someone with too much personal debt.

You are worried because you are facing significant financial challenges. It is not your fault that you are in this situation. You have been only shown the old ways that do not work anymore. The Ira Smith Team uses new modern ways to get you out of your debt troubles while avoiding the bankruptcy process. We can get you debt relief freedom using processes that are a bankruptcy alternative.

The stress placed upon you is huge. We understand your pain points. We look at your entire situation and devise a strategy that is as unique as you and your problems; financial and emotional. The way we take the load off of your shoulders and devise a plan, we know that we can help you.

We know that people facing financial problems need a realistic lifeline. There is no “one solution fits all” approach with the Ira Smith Team.

That is why we can develop a restructuring process as unique as the financial problems and pain you are facing. If any of this sounds familiar to you and you are serious about finding a solution, contact the Ira Smith Trustee & Receiver Inc. team today.

Call us now for a free consultation. We will get you or your company back on the road to healthy stress-free operations and recover from the pain points in your life, Starting Over, Starting Now.

The information provided in this Brandon’s Blog is intended for educational purposes only. It is not intended to constitute legal, financial, or professional advice. Readers are encouraged to seek professional advice regarding their specific situations. The content of this Brandon’s Blog should not be relied upon as a substitute for professional guidance or consultation. The author, Ira Smith Trustee & Receiver Inc. as well as any contributors to this Brandon’s Blog, do not assume any liability for any loss or damage resulting from reliance on the information provided herein.

CREDIT SCORES ONTARIO

CREDIT SCORES ONTARIO