If you would prefer to listen to the audio version of this bankruptcy and insolvency Brandon’s Blog, please scroll to the bottom and click on the podcast.

Bankruptcy and insolvency: Introduction

Not every innovation that is seen on The Shark Tank is bound to be one of the very best. Among the winners, Fizzics is a machine that makes use of sound waves that improve the taste and quality of a beer. Not even a Shark can stop its company from being driven to bankruptcy and insolvency Chapter 11 bankruptcy protection. This proves that often an ingenious and fantastic invention being marketed with the assistance of a Shark might not truly interest people.

Fizzics was seen on the season 8 première of The Shark Tank. The judges, in spite of the early skepticism, accepted this pitch. It currently seems to be backfiring in a huge way. The idea of making a bottle of beer taste better, just like a draft beer from the tap, isn’t a silly way to invest your time. But a better tasting beer is a big luxury. Many people may check out is the brand-new shiny plaything on the block. It is something wacky and cute but not completely effective or needed.

What is difference between bankruptcy and insolvency in Canada?

What is insolvency? – Individuals are considered to be insolvent when they are not able to pay the financial debts they owe their creditors on their respective due dates. If you become insolvent, you might choose to declare bankruptcy, or you could handle your financial debts with other options such as a consolidation loan or a debt settlement consumer proposal.

Insolvency and bankruptcy are 2 terms that are often very closely associated when discussing debt. However, they have very different meanings. Insolvency describes an economic state. It is when you cannot afford to pay your debts when due. If you liquidated all of your assets, there would not be enough money to pay off all your debts in full.

What is bankruptcy? – Bankruptcy is a legal process. It means that a creditor has gone to court and obtained a Bankruptcy Order to place a person or company into the legal status of bankruptcy. Or, the person or company has filed an Assignment in Bankruptcy. The Bankruptcy and Insolvency Act (BIA) is the Canadian bankruptcy law legislation regulating all administrations of the BIA in Canada.

The various kinds of insolvency proceedings under the BIA are:

- corporate bankruptcy;

- personal bankruptcy; either a summary administration bankruptcy or an ordinary administration.

- consumer proposals;

- Part III Division I Proposal; and

- receiverships.

Canadian BIA insolvency proceedings and bankruptcy proceedings can only be administered by licensed insolvency trustees (formerly called trustees in bankruptcy). The short form for a trustee in bankruptcy is now LIT, licensed insolvency trustee (Trustee). Trustees are licensed and supervised by the Office of the Superintendent of Bankruptcy (Canada) (OSB) which is part of Industry Canada. The OSB is responsible for the administration of bankruptcies in Canada.

Bankruptcy and Insolvency: Does the consumer really need it?

Eventually, these types of ideas are those that often tend to seem like the most effective thing since sliced bread. Their shiny brand-new finish tends to subside promptly given the expense of creating them. Even tougher, is finding a large enough market of people who truly intend to quit the dependable and old ways to carry out something. The uniqueness will swiftly wear away. The equipment will then come to be a chunk of scrap that is most likely to rest on the counter and seldom gets used. That might seem unkind, however, usefulness and need to at some point seem to divide the wheat (or barley) from the chaff!

So Fizzics, for all that it is able to do, turned out to be not the sort of device that has the ability to make a great deal of sense in a business setting. It is just for home-usage. In a bar, people go to consume alcohol and socialize. They are not there to wait on a number of sound waves to make their drink preference taste and look better. If they want a draft beer, they will order from the tap. If they want a bottled beer, that is what they will order.

For home usage, it is an excellent novelty. Everyone has their favourite beer. People anticipate it to taste the way they know it too – straight out of the bottle or can.

The Fizzics Business: The Sharks bit and invested money

Philip Petracca and his partner, David McDonald, made it to ABC’s “Shark Tank” in 2016, offering beer to a hesitant panel. They eventually turned most of the judges into followers. Lori Greiner and fellow Shark Mark Cuban agreed to spend $2 million into Fizzics for a consolidated 16.67 percent equity. Fizzics attained its objective of expanding its selling networks.

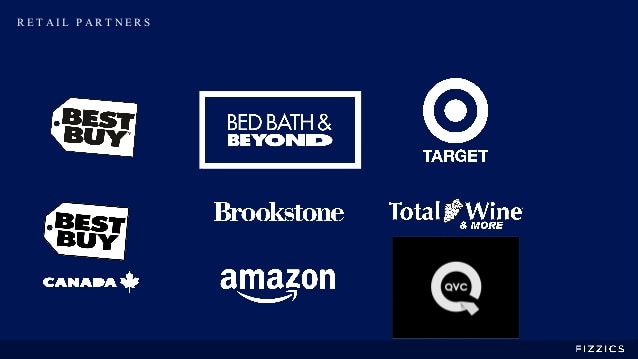

With the help of the Sharks, Fizzics entered Target, Best Buy, Brookstone, on Amazon, and several other areas– including Bed, Bath & Beyond. They have been reviewed in many renowned publications, and on several websites such as Yahoo! Tech as well as CNet. The Fizzics beer-making device was called absolutely nothing short of a wonder.

They increased their patented modern technology and generated a much more portable item called the Fizzics Waytap. Beer fanatics were still going crazy about the original dispenser in magazines.

On March 12, 2019, Fizzics Group, Inc. applied for Chapter 11 bankruptcy in Delaware under the United States insolvency and bankruptcy code. It reported assets of between $100,000 as well as $500,000 and debts of between $1 million and $10 million (based on contingencies and disputed claims). Time will tell if the business can be reorganized and saved, or if the remaining product inventory will end up in the clearance area!

Bankruptcy and insolvency: Do you need help?

I hope you enjoyed this Fizzics Shark Tank bankruptcy and insolvency blog. Do you or your business have excessive debt? Are you having an issue making your month-to-month expenses? Is your company handling its financial obstacles something you simply can’t figure the way out of? Are you looking for a business restructuring plan or an individual debt negotiation plan?

If so, call the Ira Smith Team today. We have years and generations of experience helping people and companies seeking financial restructuring or a debt settlement strategy. As a licensed insolvency trustee, we are the only specialists recognized, accredited and supervised by the Federal government to give insolvency advice and remedies to assist you and to prevent bankruptcy.

Call the Ira Smith Team today so you can end the stress and anxiety financial problems create. With the special roadmap, we will develop with and special to you, we will promptly return you right into a healthy, balanced hassle-free life.

You can have a no-cost appointment to assist you so we can fix your debt troubles. Call the Ira Smith Team today. This will certainly allow you to make a fresh start, Starting Over Starting Now.