Declaring Bankruptcies Introduction

Picture this: April 2020, and your small Canadian business survive on thin margins. Suddenly, a global pandemic hits, lockdowns ensue, and your revenue disappears overnight. Then, a lifeline appears in a twist of fate: the Canada Emergency Business Account (CEBA).

On February 18, 2025, Statistics Canada released an economic paper written by Sean Clarke, Jasper Hui, and Dave Krochmalnek, “Borrowing, repayments and bankruptcies by industry: Results from the Canada Emergency Business Account program”. This post explores how this initiative influenced many businesses’ trajectories – some soared, while others crumbled under new pressures as the pandemic’s aftermath unfolded forcing many declaring bankruptcies.

Declaring Bankruptcies: Understanding CEBA – Lifesaver or Temporary Relief?

The CEBA was introduced to help small and medium enterprises (SMEs) during the COVID-19 pandemic. But what exactly does this mean for you? CEBA aimed to provide interest-free loans to businesses struggling to survive the economic fallout. With a staggering $49 billion allocated to various sectors, it was a significant lifeline for many. But was it enough?

Overview of CEBA and Its Objectives

CEBA was designed to assist businesses in covering essential operational costs. The loans, which could reach up to $60,000 per Canadian business, were intended to keep the doors open during the toughest times. Think of it as a safety net. But how effective was this net in catching those who fell?

- Total funding: $49 billion

- Maximum loan per business: $60,000

Total Funding | Maximum Loan per Canadian Business |

|---|---|

$49 billion | $60,000 |

The Definition of Client-Facing Industries

Client-facing industries are sectors that directly interact with customers. This includes accommodations, food services, and transportation. These industries were hit hard during the pandemic. Imagine a restaurant forced to close its doors. The impact was immediate and severe. Output in these sectors dropped between 30% and 60% during the initial lockdowns. How could they survive without support?

In contrast, industries like construction and retail rebounded more quickly. Construction even saw a boom due to increased demand for single-family homes. This disparity raises questions about the fairness of the support provided. Why did some sectors receive more funding than others?

How CEBA Disbursement Shaped Business Survival

CEBA’s disbursement was crucial for many businesses. As one expert noted,

“CEBA was a crucial bridge for many businesses caught in the pandemic’s storm.”

This statement encapsulates the essence of the program. It was a bridge, but was it strong enough to support all who relied on it?

While many businesses managed to repay their loans, a significant portion—about 18.8%—remained outstanding by the forgiveness deadline. This translates to approximately $9.2 billion still owed. Instead of being forgiven, these loans transitioned into three-year term loans at a 5% interest rate. For businesses already struggling, this new burden was daunting.

Some sectors faced even higher rates of outstanding loans. For instance, the transportation and warehousing industry had 30.7% of loans outstanding. Accommodation and food services were not far behind at 21.9%. Even construction, which seemed to recover quickly, had 20.1% of loans still outstanding. This paints a picture of a complex recovery landscape.

It’s essential to evaluate the overall effectiveness of CEBA. Did it truly save businesses, or just delay the inevitable? The number of companies declaring bankruptcies decreased initially, likely due to government interventions like CEBA. However, as time passed and economic conditions changed, bankruptcy filings surged. By early 2024, over 1,200 businesses declared bankruptcy, many of which had received CEBA loans.

This situation raises critical questions. Did CEBA merely mask deeper vulnerabilities in the economy? The interconnected nature of these economic factors is evident. While CEBA provided immediate relief, the long-term implications remain uncertain.

CEBA was a significant initiative at supporting SMEs during an unprecedented crisis. However, the varying impacts across industries and the subsequent challenges faced by many businesses highlight the complexities of economic support measures. As we continue to navigate these waters, understanding the full scope of CEBA’s impact is essential for future economic resilience.

Declaring Bankruptcies: Diving into the Discrepancies – Who Benefited Most?

When we look at the impact of the CEBA program, it’s clear that not all industries were created equal. Some sectors thrived while others struggled. Why is that? Let’s dive into the numbers and uncover the surprising disparities in funding allocations and the reasons behind them.

Comparison of Industry Sectors

First, let’s consider the sectors that fared differently during the pandemic. The client services industry, which includes accommodations, food services, and transportation, saw a staggering drop of 30% to 60% in output during the initial lockdowns. That’s a significant hit! On the other hand, industries like manufacturing bounced back much quicker. In fact, construction even experienced a boom due to increased demand for single-family homes.

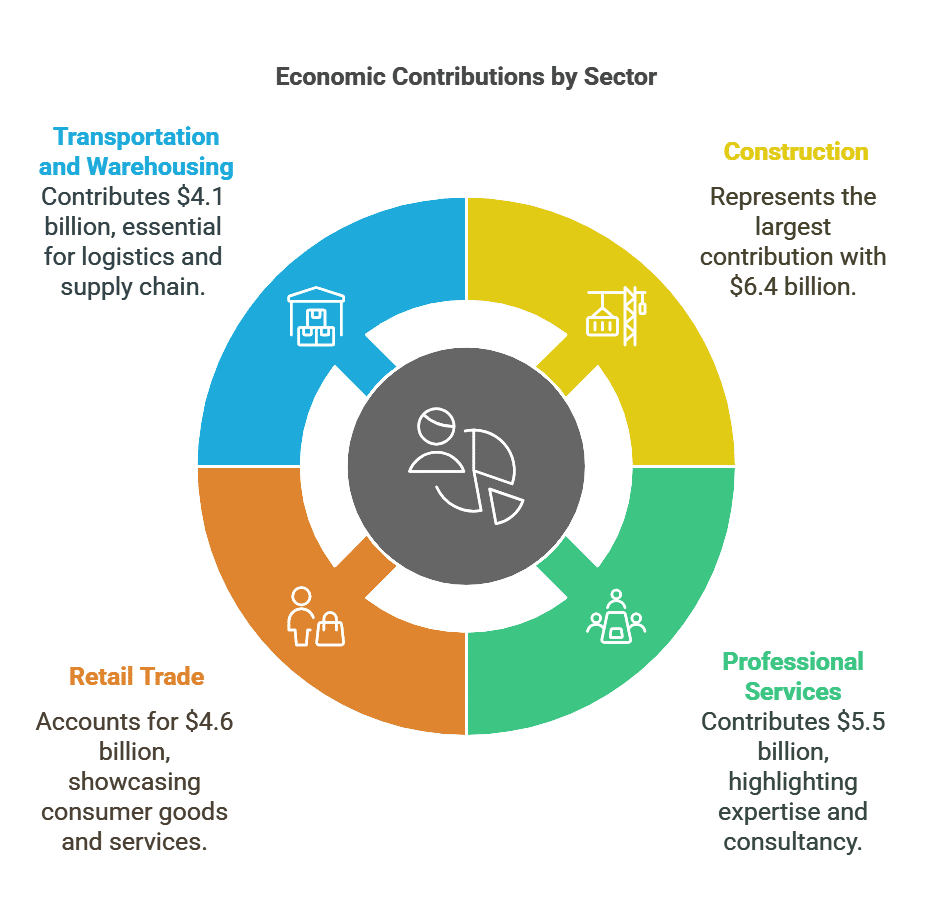

It’s fascinating to see how these differences played out in funding. Construction received a whopping $6.4 billion from CEBA, which is about 13% of the total funding. This is surprising, especially considering that construction was recovering faster than many other sectors. Why did they get such a large slice of the pie?

Surprising Funding Allocations

To put things into perspective, let’s look at the funding allocations:

- Construction: $6.4 billion

- Professional Services: $5.5 billion

- Retail Trade: $4.6 billion

- Transportation and Warehousing: $4.1 billion

These numbers reveal a clear trend. The sheer number of businesses in the construction sector likely allowed more companies to qualify for CEBA loans. But what about the service industries? They faced deeper impacts and yet received less funding overall.

Reasons Behind the Disparities

So, what explains these disparities in loan distribution? One reason is the nature of the businesses themselves. The hardest-hit sectors also had a higher rate of outstanding loans. For instance, the transportation and warehousing industry had 30.7% of loans still outstanding, while accommodation and food services faced a rate of 21.9%. Even construction had 20.1% of its loans outstanding, indicating that not all businesses in recovering sectors were out of the woods.

As you can see, the funding landscape is complex. While some sectors received substantial support, others were left to fend for themselves. This raises important questions about the effectiveness of such programs. Are they truly helping those in need, or are they simply delaying the inevitable for some businesses?

As we explore the outcomes of the CEBA program, it’s crucial to consider the broader implications. The differences in funding allocations and the varying impacts on different sectors highlight the need for tailored economic support strategies. Understanding these nuances can help us navigate future economic challenges more effectively.

Declaring Bankruptcies Trends: The Consequences of CEBA

The CEBA was a lifeline for many businesses during the pandemic. It provided essential financial support when the world was in turmoil. But what happened after the loan forgiveness deadline? This question is crucial as we analyze the trends in corporate bankruptcies that emerged in the wake of CEBA.

Initial Effects of the Loan Forgiveness Deadline

When the loan forgiveness deadline approached, many businesses faced a harsh reality. A staggering 18.8% of CEBA loans remained outstanding. This meant that instead of being forgiven, these loans transformed into three-year term loans with a 5% interest rate. For businesses already struggling, this was like adding fuel to a fire.

Imagine running a small restaurant. You relied on that loan to keep your doors open during lockdowns. Now, you have to pay it back with interest. How do you manage that when customers are still hesitant to return? This scenario played out in many sectors, particularly those that were client-facing.

Rising Bankruptcy Rates in Various Sectors

As we moved into early 2024, bankruptcy rates surged. In the first quarter alone, there were 12,000 bankruptcies. Alarmingly, 39% of these corporate bankruptcies involved businesses that had taken CEBA loans. The ticking time bomb of conversion to debt ultimately revealed serious vulnerabilities in many businesses once they started incurring CEBA debt service costs.

- Accommodation and food services were hit hardest, accounting for 20.3% of bankruptcies among CEBA participants.

- Retail trade and construction followed, with 13.7% and 11.8% respectively.

These numbers paint a grim picture. The pandemic had already decimated many businesses. Now, the added burden of repaying loans pushed some over the edge. It’s like trying to swim with weights tied to your ankles. You can only struggle for so long before you sink.

Impact of Economic Conditions Post-Pandemic

The economic landscape post-pandemic was anything but stable. Rising interest rates and escalating input costs created a perfect storm. Businesses that had managed to survive the initial lockdowns now faced new challenges. The combination of these factors led to a significant increase in declaring bankruptcies.

In fact, the report indicates that while bankruptcy rates initially decreased during the pandemic, they reversed course in mid-2022. This shift coincided with the looming deadline for loan forgiveness. As businesses scrambled to adapt, many found themselves unable to cope with the financial strain.

Consider the transportation and warehousing industry. They had a staggering 30.7% of loans outstanding. Even sectors that seemed to recover quickly, like construction, faced challenges. About 20.1% of construction businesses still had loans outstanding. This suggests that the recovery was not uniform across industries.

As you reflect on these trends, it’s clear that the CEBA program had both positive and negative effects. While it provided immediate relief, the long-term consequences are now unfolding. Businesses are left grappling with financial obligations, and the economic recovery remains fragile.

In summary, the consequences of CEBA are complex. The initial relief provided by the loans has transitioned into a burden for many. As bankruptcy rates rise, it’s essential to understand the interconnected nature of these economic factors. The pandemic has left its mark, and the path to recovery is fraught with challenges.

The Ripple Effect: Beyond Declaring Bankruptcies

The economic landscape has changed dramatically in recent years. The COVID-19 pandemic shook businesses to their core. Many faced unprecedented challenges. But what happens when the dust settles? What are the long-term implications of the support provided, like the Canada Emergency Business Account (CEBA)? Let’s dive into the ripple effects of these financial lifelines.

1. Long-Term Economic Implications

When we think about the CEBA program, we often focus on immediate relief. However, the long-term effects are just as crucial. Businesses received interest-free loans, but at what cost? The loans were meant to provide a safety net, yet they may have created a larger debt burden. This can stifle growth in the long run.

- Debt Burden: Many businesses now face significant repayments. This can limit their ability to invest in growth.

- Market Dynamics: With rising debt, companies may become more risk-averse, avoiding new ventures.

- Sector Disparities: Some industries, like construction, received more funding but recovered faster. Others, like food services, are still struggling.

It’s essential to ask: Are we setting businesses up for success or failure? The answer may lie in how these loans are managed in the future.

2. The Impact of Rising Inflation and Interest Rates

Inflation and interest rates are like the weather—unpredictable and often harsh. As inflation rises, so do costs for businesses. This can squeeze profit margins. Additionally, interest rates have been climbing, making it harder for companies to manage their debt.

- Cost of Goods: Rising prices can lead to increased operational costs.

- Loan Repayments: Higher interest rates mean higher repayments. This can be a heavy burden putting pressuer on being able to repay both secured creditors and unsecured creditors.

- Consumer Behaviour: As costs rise, consumers may cut back on spending, affecting sales.

As one expert put it,

“It’s a complex interplay of factors—like juggling flaming swords while riding a unicycle through a storm.”

This analogy perfectly captures the precarious balance businesses must maintain.

3. Vulnerability in Businesses Pre- and Post-Pandemic

The pandemic revealed vulnerabilities in many businesses. Some were already struggling before COVID-19 hit. The support from CEBA helped, but it also masked deeper issues. Now, as the economy shifts, these vulnerabilities are resurfacing.

- Pre-Pandemic Weakness: Many businesses were operating on thin margins. The pandemic exposed these weaknesses.

- Post-Pandemic Recovery: As the economy reopens, businesses must adapt. Those that don’t may face business bankruptcy.

- CEBA Recipients vs. Non-Recipients: Interestingly, CEBA participants had a bankruptcy rate of 0.7% compared to 1.3% for non-participants. This shows that support can make a difference, but it’s not a cure-all.

As we analyze the data, it’s clear that while CEBA provided immediate relief, it also created a new set of challenges. Businesses are now navigating a complex landscape of debt, rising costs, and changing consumer behavior.

The ripple effects of the CEBA program are profound. The long-term economic implications, the impact of rising inflation and interest rates, and the vulnerabilities exposed during the pandemic all intertwine. As businesses continue to adapt, they must find ways to manage their debts while also investing in future growth. The journey ahead is uncertain, but understanding these factors will be crucial for navigating the new economic reality.

A Cautious Path Forward: Lessons Learned

The COVID-19 pandemic has left many businesses grappling with vulnerabilities. As we reflect on the lessons learned from the CEBA program, it’s essential to consider how we can move forward. What can we take away from this experience? How can we ensure that future financial programs are more effective and sustainable?

Takeaways for Future Financial Programs

First and foremost, we need to recognize that not all businesses are created equal. Different industries have different needs. The CEBA program provided crucial support, but it also highlighted the disparities in recovery among sectors. For instance, while construction thrived, accommodations and food services struggled. This brings us to a vital takeaway: future financial programs must be tailored to the specific needs of industries.

- Understand industry-specific needs: Programs should be designed with a clear understanding of the unique challenges faced by different sectors.

- Flexibility is key: Financial support should be adaptable, allowing businesses to pivot as conditions change.

- Monitor outcomes: Regular assessments can help identify which programs are working and which are not.

The Importance of Targeted Support

Targeted support is crucial for effective recovery. The CEBA program showed us that blanket solutions often miss the mark. For example, many businesses in the transportation and warehousing sector faced significant challenges, with 30.7% of loans remaining outstanding. This indicates that a one-size-fits-all approach can lead to unintended consequences.

As we move forward, we must ask ourselves: How can we provide support that truly meets the needs of businesses? The answer lies in targeted interventions. By focusing on specific sectors, we can ensure that resources are allocated where they are needed most.

Looking Ahead to Sustainable Recovery Strategies

Looking ahead, sustainability in economic recovery is paramount. As the quote goes,

“Sustainability in economic recovery depends on a nuanced understanding of industry needs and vulnerabilities.”

This means that recovery strategies must be holistic and context-sensitive. We need to consider not just immediate relief but also long-term resilience.

Some strategies to consider include:

- Investing in training and development: Equip businesses with the skills they need to adapt to changing markets.

- Encouraging innovation: Support businesses in developing new products or services that meet emerging demands.

- Building partnerships: Foster collaboration between businesses, government, and community organizations to create a supportive ecosystem.

The lessons learned from the CEBA experience are invaluable. We must embrace a more nuanced approach to financial support, one that recognizes the unique challenges faced by different industries. By focusing on targeted support and sustainable recovery strategies, we can help businesses navigate the complexities of the post-pandemic landscape. The road ahead may be cautious, but with the right strategies in place, we can foster resilience and ensure a brighter future for all. Remember, the key to successful recovery lies in understanding the diverse needs of our economy and responding accordingly.

Declaring Bankruptcies: CEBA FAQ

What was the purpose of the Canada Emergency Business Account (CEBA) program?

The CEBA program was introduced by the Government of Canada on March 27, 2020, to provide interest-free loans to eligible small and medium-sized businesses to help cover their operating costs during the COVID-19 pandemic. The loans were up to $60,000, with a portion (up to one-third) forgivable if repaid by a set deadline. The aim was to help businesses maintain solvency and operations during a period of significant economic disruption.

Which industries received the most CEBA funding and why?

The construction industry received the most CEBA funding, totaling over $6.4 billion (13.1% of total loan disbursements), largely distributed among residential building construction businesses, building equipment, and building finishing contractors. This was partly due to the high number of legal entities within the construction sector. Client-facing service industries such as professional, scientific, and technical services; retail trade; transportation and warehousing; and accommodation and food services also received significant funding because they were among the most severely impacted by public health restrictions and disruptions to traditional business operations.

What were the repayment terms and deadlines for CEBA loans?

The original repayment deadline to qualify for partial loan forgiveness was December 31, 2022. This was extended to December 31, 2023, and then again to January 18, 2024. If the loan was not repaid by this final deadline, the outstanding balance was converted into a three-year term loan, subject to an interest rate of 5% per annum, with the loan forgiveness option no longer available. The final repayment date for these term loans is December 31, 2026.

Which industries had the highest rates of outstanding CEBA loans after the repayment deadline?

Industries that were hardest hit by pandemic-related lockdowns and experienced slower recoveries tended to have the highest rates of outstanding CEBA loans. These included transportation and warehousing (30.7% outstanding), administrative and support, waste management and remediation services (22.7% outstanding), accommodation and food services (21.9% outstanding), and construction (20.1% outstanding). These sectors often faced prolonged disruptions and financial pressures, making it difficult to repay loans by the deadline.

How did bankruptcies among CEBA borrowers change during and after the pandemic?

Business bankruptcies initially declined in the first half of the pandemic but began to accelerate in mid-2022, reaching a high in the first quarter of 2024, coinciding with rising interest rates, elevated input costs, and the end of the CEBA program forgiveness period. The proportion of bankrupt businesses that had taken out CEBA loans increased from 39% in the first quarter of 2021 to 70% in the first quarter of 2024. After this acute period, bankruptcies dropped sharply over the remainder of 2024.

Which industries saw the most bankruptcies among businesses that had received CEBA loans?

The accommodation and food services industry accounted for the largest share of bankruptcies among CEBA borrowers (20.3%), with full-service restaurants and limited-service eating places being particularly affected. Retail trade (13.7%) and construction (11.8%) also had significant proportions of CEBA borrowers declaring bankruptcy.

What were the overall bankruptcy rates for CEBA borrowers compared to non-borrowers?

Of the 898,271 CEBA borrowers, 6,343 (0.7%) eventually declared bankruptcy by the end of September 2024. In contrast, the overall bankruptcy rate for all businesses between the second quarter of 2020 and the third quarter of 2024 was 0.9%, and for businesses that did not take CEBA loans, the bankruptcy rate was 1.3%. This suggests that while many CEBA borrowers did face bankruptcy, their overall rate was lower than that of businesses that did not receive CEBA support.

What were the expectations of businesses regarding their ability to repay outstanding CEBA loans?

According to Statistics Canada’s Survey on Business Conditions, nearly two-thirds (65.6%) of businesses with outstanding CEBA loans anticipated having the liquidity or access to credit to repay the loan by December 31, 2026. However, approximately one-fifth (19.9%) were uncertain about their ability to repay, and 14.5% did not expect to have the necessary liquidity or credit access, indicating that repayment challenges persisted for a significant minority of businesses.

Declaring Bankruptcies Conclusion

The CEBA provided crucial financial lifelines to many businesses during the COVID-19 pandemic. However, disparities in funding distribution and subsequent declaring bankruptcies highlight a complex economic landscape that continues to evolve. Don’t let the storm of bankruptcy catch you off guard. Take proactive measures now, and you may find yourself on the path to recovery.

I hope you enjoyed this declaring bankruptcies Brandon’s Blog. Do you or your company have too much debt? Are you or your company in need of financial restructuring? The financial restructuring process is complex. The Ira Smith Team understands how to do a complex restructuring. However, more importantly, we understand the needs of the entrepreneur or someone with too much personal debt.

You are worried because you are facing significant financial challenges. It is not your fault that you are in this situation. You have been only shown the old ways that do not work anymore. The Ira Smith Team uses new modern debt relief options to get you out of your debt troubles while avoiding the bankruptcy process. We can get you debt relief freedom using processes that are a bankruptcy alternative.

The stress placed upon you is huge. We understand your pain points. We look at your entire situation and devise a strategy that is as unique as you and your problems; financial and emotional. The way we take the load off of your shoulders and devise a plan, we know that we can help you.

We know that people facing financial problems need a realistic lifeline. There is no “one solution fits all” approach with the Ira Smith Team.

That is why we can develop a restructuring process as unique as the financial problems and pain you are facing as your alternative to bankruptcy. If any of this sounds familiar to you and you are serious about finding a solution, contact the Ira Smith Trustee & Receiver Inc. team today.

Call us now for a free consultation. We will get you or your company back on the road to healthy stress-free operations and recover from the pain points in your life, Starting Over, Starting Now.

The information provided in this Brandon’s Blog is intended for educational purposes only. It is not intended to constitute legal, financial, or professional advice. Readers are encouraged to seek professional advice regarding their specific situations. The content of this Brandon’s Blog should not be relied upon as a substitute for professional guidance or consultation. The author, Ira Smith Trustee & Receiver Inc. as well as any contributors to this Brandon’s Blog, do not assume any liability for any loss or damage.