Canadian payday loans – The Problem

Canadian payday loans – The Problem

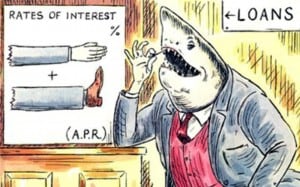

Canadian payday loans offered through payday loan companies are a scourge on society. Payday lenders must not be allowed to run. They take advantage of the disadvantaged part of our population who can least afford it. Canadians need protection from payday lenders and it’s high time that the government stepped in and took action. The Ira Smith Team can’t change the law on payday lenders but we can do our best to alert you to the dangers of payday loan companies with our blogs.

- Online Payday Loans Toronto: Google Finally Realizes Its Huge Mistake!

- Payday Loan Companies: Are You Into Pawn?

- Payday Loan Companies – Update

- Payday Loan Companies: There are Options

- 10 Ways a Payday Loan Charges Illegal Interest

- Bad Credit Loans Toronto: Legit Companies Don’t Guarantee Them

- Bad Credit Loans Online Attack the Already Vulnerable

- Payday Loan Companies Targeting You With Mobile Apps!

- Canadian Payday Loans No Credit Check: Too Good To Be True!

- Payday Loans: Ontario Cracks Down on the Cash Store

- Payday Loans are Not the Answer to Your Financial Problems

Why is the USA ahead of Canada?

When it comes to payday loan companies, the U.S. government seems much more on the ball than the Canadian government. In Canada, it’s the individual provinces that cap the rate lenders can charge borrowers in interest and they apparently aren’t doing much to protect their citizens.

In Ontario the province caps interest on payday loans at $21 per $100 dollars for a two-week period. This may not sound like much to you but on an annual basis it comes to 546%. This is not a typo. The annual interest is 546%.

Canada’s criminal usury rate is 60%. Payday loans are very short-term so they aren’t expressed as annualized amounts making it very easy for payday lenders to hide the fact that you’re actually paying 546% interest on Canadian payday loans.

What is the U.S. government doing about payday lenders?

The U.S. Consumer Financial Protection Bureau has proposed the following regulations:

- Lenders must conduct a “full-payment test.” This means that payday loan companies would have to prove that borrowers are able to repay the money without having to renew the loan repeatedly. Typically most payday loans are required to be paid in full two weeks to one month after the person borrows the money and this sets off a cycle of borrowing to repay the previously borrowed money.

- Restriction on the several times a borrower can renew the loan.

- Lenders must give extra warnings before attempting to debit a borrower’s bank account. This should lower the frequency of overdraft fees that are common with people who take out payday loans.

- Restriction on the several times the lender can attempt to debit the account.

What can the Canadian government do about Canadian payday loans?

Canadian activists ACORN are urging the Canadian government to follow the U.S. in regulating these predators. In addition, ACORN is proposing that the federal government:

- Create a national database of payday loan users to stop users from taking out a loan to pay off another.

- Cap all payday loan fees at $15 on every $100.

- Amend the Criminal Code to lower the ceiling for the interest rate from 60% to 30%.

“Too many borrowers seeking a short-term cash fix are saddled with loans they cannot afford and sink into long-term debt,” CFPB Director Richard Cordray said in a statement. “Many borrowers turn to payday loans for fast cash to cover bills when they are rejected by the banks. This allows payday lenders to take advantage of people who have nowhere else to turn”, said Tom Cooper, director of the Hamilton Roundtable for Poverty Reduction. “The predatory nature of payday loans is a failure of the national banking system, which means they should be a federal responsibility”.

Is there an alternative to Canadian payday loans?

According to Duff Conacher, co-founder of Democracy Watch, the alternative is the federal government direct that banks must have branches in low-income neighbourhoods that offer credit lines to lower-income people at the same rate they offer to others. That, he said, would end the need for payday lenders.

What is the solution?

Please don’t resort to payday loan companies! Make a date for a free consultation with a professional trustee instead. Ira Smith Trustee & Receiver Inc. is here to help with sensible advice and a plan to conquer your debt problems so that you can rid yourself of debt Starting Over, Starting Now. Give us a call today.