If you would rather listen to the two income trap blog audio file, please scroll down to the end for the podcast.

Two income trap: Introduction

In the last 50 years, women have entered the labour force in real numbers. This did not result in families having a much easier time of it economically. A great number of people thought it would because a family now had two full-time income earners. Financial troubles might if anything be much more extensive among two income households today. This is called a two income trap.

Two income trap: Senator Elizabeth Warren

I recently read an article on the United States Senator Elizabeth Warren. I had not been actually familiar with her history prior to reviewing the write-up. Turns out that she was a lawyer who focussed on bankruptcy legislation. She was a professor at the Harvard Law School.

Senator Warren’s daughter, Amelia Warren Tyagi, is an entrepreneur and management consultant. They co-authored a book “The Two-Income Trap: Why Middle-Class Mothers and Fathers Are Going Broke“. It was first released in 2003 and an updated version was released in 2016. The book is a sociological review of exactly how American households and life have developed from the 1960s to contemporary times. Although it is a testimonial of American life, I think the same concepts and conclusions can be related to Canada’s middle class too.

Two income trap: The rise in middle-class insolvencies

One reality that bothered the writers was that by the early 2000s, bankruptcies in the middle class became greater than in any other American socio-economic group. To put it simply, when considering the family members that are declaring bankruptcy, it’s not the extremely poorest or the really wealthiest. It actually has to do with the middle class and the kind of financial difficulties they meet.

The writers wished to attempt to clarify why much more middle-class households, making even more than ever previously, saw a 500% rise in individual bankruptcy filings from the very early 1980s to the very early 2000s. The writers likewise keep in mind that along with personal bankruptcies, home mortgage foreclosures were up greater than 3.5 times than in the very early 1980s. This is prior to the 2008 economic disaster mess!

Two income trap: The financial disintegration of the middle-class household

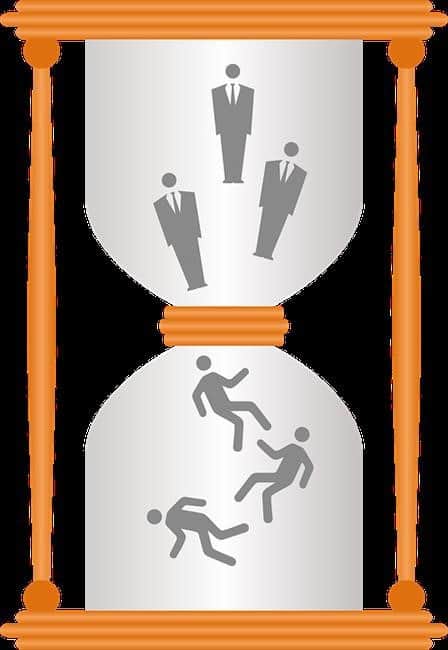

Their study began with a solitary reality. The possibility that a family with youngsters would wind up in bankruptcy is more than families without children. They uncovered that households that have youngsters in the family are almost 3 times more likely to wind up declaring bankruptcy than households that do not have children.

The writers think it is really vital to comprehend the problems triggering middle-class economic issues. This is due to the fact that they discovered that 2 out of every 3 households that applied for bankruptcy have actually had a real job loss or loss of income prior to their declaring bankruptcy.

Someone’s lost a job; a person’s had a major downturn when it comes to households where both the husband and wife work. Sometimes both of them have actually lost their job before bankruptcy. So we’re actually talking about individuals that are not just way down on the earnings side. They had no financial savings or emergency money fund to draw on when the unanticipated calamity struck. Stating it a different way, households were damaged attempting to have a middle class lifestyle!

This concern fascinated the writers. We can comprehend the young and careless declaring bankruptcy. We can also recognize a tale about seniors in debt that states decreasing health, limited revenue, no potential to make extra in the future and insufficient funds for retired life will certainly have financial issues. Nevertheless, in the case of seniors in debt, the reasons for their financial difficulties probably began a very long time ago. With restricted earnings and no financial savings to draw on, revealed the concerns which already existed.

Two income trap: The newer generation middle class

Insolvency stories about women and men working and raising children are normal today, but this was not so in the very early 1980s and earlier.

In those days, middle-class stories were not about creating debt to purchase consumable or lifestyle items they cannot afford. Stories about the current middle class in financial trouble inevitably show similar primary factors why these family members wind up bankrupt. They are attempting to spend on not only food and clothing but other costs that have become family fixed costs, such as:

- home loan repayments;

- additional medical insurance repayments;

- daycare expenses

- after school care expenses; and

- auto payments

Middle-class families need to have 2 automobiles when both mother and father are in the labour force. The spread of suburban life families have out of necessity opted to get more space for the dollar and overall affordability, also demands being a 2 car family. By the time they make all their fixed cost payments, those two income households think about what was supposed to be their financial success tale.

They have much less cash left over than their one-income dads’ or grandfathers’ households had. It appears that as our society modernizes and allows people to do a lot more, the ambitions of middle-class families do not always come to fruition. The middle class has been and continues to shift. The middle-class size has reduced compared to the 1970s. Families have been either moving up or down. On a net basis, the middle class has not been growing.

This actually does not amaze me. When you have children your expenditures jump astronomically. As lately as the very early 1970s, a Canadian household had buying power on one income. It certainly gave a middle-class way of living. What took place in the 1960s and 1970s, is one income sufficed to sustain a household in what was a typical and comfortable middle-class life.

It absolutely was middle class; it was right in the centre. You may have needed to clip coupons to save money, yet you were buying your food at grocery stores, not going to a food bank. Your home could have been small, yet it was your own and you had the want and ability to hive off savings from your regular employment income to pay off your only mortgage quicker.

Two income trap: So what has changed?

That generation recognized exactly how to stick to a spending plan. They were more successful than their parents’ generation. They learned lessons from their parents about: (i) money; (ii) budgeting; (iii) saving for an objective; and (iv) understanding and being OK with if you cannot pay cash now for something, you simply do not buy it.

Now with both parents in the labour force, expenditures for dining in a restaurant more often, more expensive clothing, gas for the two cars are instances of regular expenditures the modern family has. One or two generations ago families did not have the same level of those kinds of expenses. Modern families spend a lot more than simply for what was the core fundamentals. We constantly recognize that having children is costly. Yet something has taken place in a single generation. The expense of living for a family with kids has actually made what once was a common middle-class life out of reach for the ordinary typical income earner.

Nowadays, the level of a household’s fixed costs is not how an economist would look at costs as compared to the income level. Rather, it is how people today understand what a two income family’s costs realistically are at the same income level. In modern-day culture, people are dining in restaurants a lot more, have home appliances and communication devices that did not exist 1 or 2 generations earlier. Housing expenses have boosted considerably. This is the brand-new facts of life for the contemporary culture household.

Two income trap: So here is the key to release you from the trap

Canadians have a financial literacy problem. Lots of people assume that some are born rich while others are not. The fact is that in most cases, those that are well off simply have a much more reasonable understanding on costs and how to live within one’s means. They also have willpower. In the past, people thought first if they could actually afford something before they spent their money on it. They don’t just look at the interest rate and monthly payment incurring that new debt will have.

I have written several blog posts alerting Canadians about the need to budget and plan thoroughly to make sure that expenses do not surpass income. A spending plan requires to consist of savings; both for an emergency reserve and for retired life. Those that do not do so are more likely to be in financial trouble when an unforeseen occasion happens. It is because they have absolutely nothing to draw on in lean times.

There are many ways to start early in life to avoid financial disaster. If it sounds familiar, that’s due to the fact that they are. Nonetheless, yet few people value them. That’s partly due to the fact that they weren’t taught in either the home or in the schools.

Financial proficiency, like civics education and learning, requires to be a demand in all primary school, secondary school as well as university curricula.

So the key to being released from this trap is twofold:

- behaviour modification; and

- financial literacy being taught at all education levels

Two income trap: Are you caught in the two-income trap?

Are you caught in the two income trap? Worried that future interest rate hikes will make presently affordable debt entirely out of reach? Is the discomfort, stress, and anxiety too much debt brings on negatively affecting your health and wellness?

If so, call the Ira Smith Team today. We have decades and generations of experience helping people and companies needing financial restructuring. As a licensed insolvency trustee, we are the only professionals licensed and supervised by the Federal government to supply financial restructuring services.

Call the Ira Smith Team today to make sure that we can begin aiding you to return right into a healthy and balanced and well-balanced, worry-free life.

We will provide a no-cost consultation to aid you to resolve your money troubles. We understand the pain debts and financial distress triggers. We can end it from your life. This will certainly allow you to begin a clean slate, Starting Over Starting Now.

[monkeytools msnip=”http://monkeyplayr.com/playr.php?u=5173&p=20141″]

What defines the middle class in Canada?

What defines the middle class in Canada?