Beware of both old and new phishing scams

We previously published three blogs and one vlog warning about various phishing scams:

- BEWARE OF PHISHING AND SPEAR PHISHING SCAMS

- VAUGHAN DEBT COUNSELLING ADVISES BEWARE OF TAX SEASON SCAMS

- CANADA REVENUE AGENCY SCAMS: IF YOU READ ONE ARTICLE, READ THIS ONE

- #VIDEO: CRA PHONE SCAM: IF YOU WATCH ONLY 1 VIDEO WATCH THIS ONE!#

The vlog on the CRA phone scam was published in December 2015. Since then, I know several people who received the CRA phone scam call and one person who actually fell for it and was defrauded.

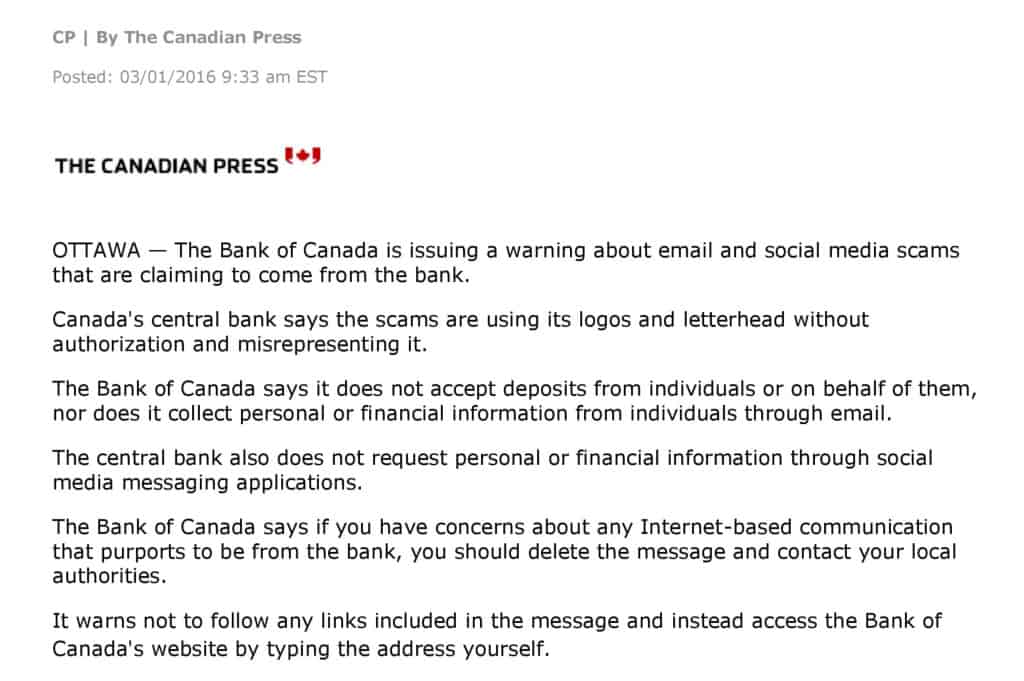

On March 1, 2016, the Bank of Canada issued a press release on the Bank of Canada email scam, one of the newest phishing scams around. Here is a copy of the Bank of Canada press release:

Since the CRA phone scam remains rampant and now there is a Bank of Canada email scam. we wish to again present to you, as a caution to remain vigilant, our video on the CRA phone scam and to protect yourself against the scammers.

What to do if you are a victim of one of the phishing scams and have too much debt

If you’ve been scammed by one of the phishing scams, and now are trapped with high debt that you cannot repay, you need a professional trustee to help you manage the situation before it reaches a critical stage where bankruptcy is your only option. We have been able to help many individuals carry out a successful debt settlement program. It all began with debt counseling. The first step is a realistic household budget. Successful completion of such a program, will free you from the burden of your financial challenges to go on to live a productive, stress-free, financially sound life.

If you’re like many Canadians on the brink of a financial crisis, you need the help of a professional trustee today while you have options. The Ira Smith Team can help before disaster strikes. There is a way to manage debt Starting Over, Starting Now. Contact us today.