- The rise of average student loan debt

- The growth in average tuition fees

- Students now taking on higher levels of average student loan debt

- Societal issues caused by rising average student loan debt statistics

- Average student loan debt causes affect the Canadian economy

- Do you have too much debt? Then contact us now

The rise of average student loan debt

Thank you for reading our Brandon's Blog. Check out our AI insolvency bot on this page and don't forget to subscribe!

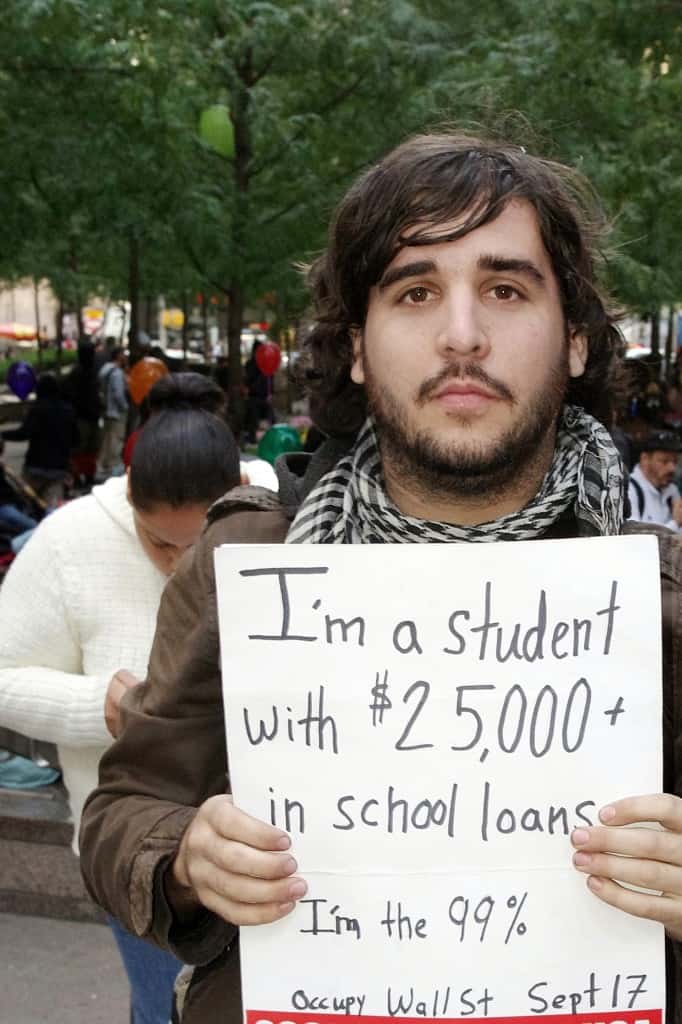

Average student loan debt is getting out of control. Post-secondary education is effectively a need for today’s labour market. According to the Canadian Federation of Students in its paper titled: “The Impact of Student Debt”, unfortunately, since the demand for education has inflated, public funding did not keep up. Public funding shortfalls have resulted in the increased cost of post-secondary education being borne by students.

The growth in average tuition fees

From 1990 to 2014, the national average tuition fees have seen an inflation adjusted increase of over one hundred and fifty per cent (150%). In Ontario, tuition fees have grown over one hundred and eighty percent (180%). For most students—often having spent very little time active within the workforce, other than for part-time work—funding their education has become more and more troublesome.

Students now taking on higher levels of average student loan debt

Many students are now taking on increased levels of debt for their education. Students requiring a Canada Student Loan currently graduate with an average student loan debt of over $28,000. Keep in mind that this is an average, with the costs of graduate education resulting in higher debt levels. Relying on debt to finance education suggests that there is a delay in the full impact of high tuition fees till after graduation—when interest begins to be charged.

Societal issues caused by rising average student loan debt statistics

This impact is now exacerbated by the effects of the most recent recession and the rising trend of precarious, and even unpaid, employment. The broader effects of high levels of student debt on both the person and the general economy are now resulting in various issues:

- Young Canadians (15-24) accounted for over half of job losses over the last 5 years;

- Un and under-employment can cost the Canadian economy over $22 billion by 2031;

- In 2014, youth un and under-employment was twenty-seven per cent (27%);

- Thirty per cent (30%) of medical students expect to graduate with over $100,000 in student debt;

- Under-employment and work outside one’s field of study results in talent degradation, falling behind in ability, and lost networking opportunities;

- Canada has seen a fifteen per cent (15%) growth in Canadians under the age of 30 who still live in their parent’s home since 1981;

- Those with student debt have a fewer assets, savings or investments compared to debt-free peers.

Average student loan debt causes affect the Canadian economy

Starting out with huge debt and facing a weak labour market, this prevents graduates to fully take part within the Canadian economy. Student debt impacts career selections, even among professional school graduates in medicine and law. An estimate of unpaid internships is in the range of 300,000 graduates working with no pay.

Do you have too much debt? Then contact us now

If you are an individual or company who needs to free themselves from the stress and strain of too much debt, and especially if you have been told your situation is hopeless, Ira Smith Trustee & Receiver Inc. can prepare and carry out the plan made just for you, to free you from the burden of your financial challenges to go on to live a productive, stress-free, financially sound life.

Student loan debt has its own set of unique rules and complexities within the Canadian insolvency scheme. If you’re experiencing serious debt issues, contact a professional trustee for a free, no obligation consultation. The Ira Smith Team does not try to write new insolvency law or tax law. Rather, we will evaluate your situation within the existing statutes, and help you to arrive at the best possible solution for your problems, whether that solution is a bankruptcy alternative like credit counselling, debt consolidation or a consumer proposal or bankruptcy. Starting Over, Starting Now you can be debt free with the help of a professional, licensed trustee in bankruptcy. Contact us today.