Ponzi scheme criminals: Introduction

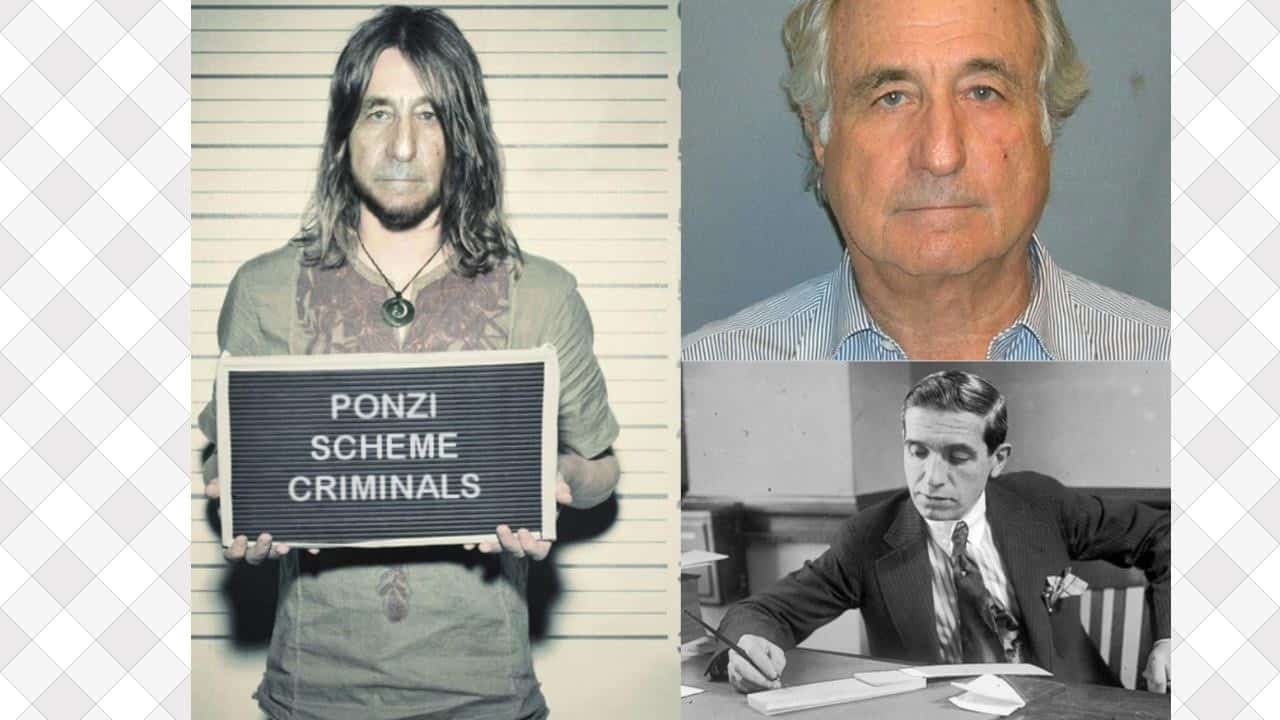

We now have a Canadian to add to the long list of Ponzi scheme criminals. A Ponzi scheme is a fraud perpetrated on unsuspecting parties in which belief in the success of a non-existent enterprise through the payment of quick returns to the first investors from money invested by later investors.

Ponzi scheme criminals: What is a Ponzi scheme?

The name comes from the swindling ways of an Italian born con man in the late 1890’s and early 1900’s – Carlo Pietro Giovanni Guglielmo Tebaldo Ponzi – known in North America as Charles Ponzi. The most famous of the modern-day Ponzi scheme criminals is Bernard (Bernie) Madoff, who is serving 150 years in prison for his multi-billion dollar Ponzi scheme.

Ponzi scheme criminals: Canadian Wade Robert Closson, Ponzi scheme criminal

Canadian Wade Robert Closson, a 48-year-old Sturgeon County, Alberta resident was recently sentenced to seven years in jail for executing a Ponzi scheme. He was originally charged in over 80 counts of fraud. Mr. Closson plead guilty to 53 counts. Most of the fraudulent activities encompassed more than one victim, typically a husband and wife pair. Several of them were present in Court and read their victim impact statements. Others were read on behalf of the victims.

Ponzi scheme criminals: His swindle has caused financial devastation

Many of the victims were discussing feelings of shame. They have experienced overall financial devastation. Some are now still working at the ages of 83, not being able to retire. As a result of the fraud perpetrated upon them by Mr. Closson, they cannot afford to take a vacation or go out for a dinner.

Ponzi scheme criminals: With friends like Mr. Closson……….

Mr. Closson was actually friends and even related to many of the victims. Most of them are talking about the loss of trust in their friend, in humanity and their ability now to relate to other human beings.

He preyed on his friends and relatives, who recruited from their social circles to invest with Closson. A number who lost money in the scam lost more than $100,000 with one suffering a loss of over $600,000. This included cash from a credit line and their RRSP. Closson took $80,000 of that amount out of the couple’s accounts without their authorization.

Ponzi scheme criminals: Essentially, it was a mortgage scam

The overall size of the fraud itself was $11 million dollars that ran through the Ponzi scheme. The Crown was able to prove losses of about $6 million dollars. That is what was in the agreed statement of facts.

The Court heard how Mr. Closson ran the Ponzi between 2006 and 2013. He operated two firms, Optam Holdings Inc. (Optam) and Infinivest Mortgage Investment Corporation (Infinivest), which both entered into bankruptcy in 2013. Closson would take the cash invested in Infinivest to pay off the investors in Optam.

When Optam applied for bankruptcy it detailed about $10 million in liabilities spread out among 69 creditors. The biggest one was Infinivest, which Optam owed $4 million.

Ponzi scheme criminals: He recruited friends and family to be on his sales team

Closson made use of the cash to pay himself around $1.185 million throughout the period of the fraud. He used an unspecified amount of money for at least one vehicle, credit cards and golf club. Mortgage payments for his mother-in-law and father-in-law too.

He incentivized people to bring in others into his scheme by paying a commission to his buddies and family members. He invested in various other companies, including a financial investment in a firm that operated a lumber mill in Nicaragua. This investment did not work out well either.

Ponzi scheme criminals: The sentencing

In Court, Closson apologized for his activities and requested the forgiveness of the 20 victims who attended Court for the sentencing!

Justice Belzil ordered Closson to pay restitution of $5.8 million he lost in the Ponzi plan together with a fine of $10,600. He is banned for life from trading in securities.

The Ponzi plan spurred an examination by the Alberta Securities Commission which fined Closson $1 million and banned him from trading in the Province of Alberta in 2015. Up until now Closson has made no payments.

“It is one thing to be taken advantage of by a stranger but this was a trusted friend,” Justice Paul Belzil said when sentencing Mr. Closson.

Ponzi scheme criminals: Wade Closson, the undischarged bankrupt

Closson and his spouse have both filed for bankruptcy on March 27, 2013. He remains an undischarged bankrupt with a hearing set for his discharge from bankruptcy. No doubt that hearing was adjourned until the outcome of the criminal trial was known. Even if Mr. Closson does one day receive a discharge from bankruptcy, the Court fine and the restitution Order, because the restitution is a liability arising out of fraud, will follow him for the rest of his life.

How the bankruptcy discharge process works has been a topic of several of my blogs in the past, including, BANKRUPTCY DISCHARGE: THE TOP 8 THINGS THE BANKRUPTCY COURT WILL CONSIDER ON ANYONE’S BANKRUPTCY DISCHARGE APPLICATION.

Ponzi scheme criminals: Do you have too much debt?

Have you taken on debt that you cannot repay as a result of being swindled from a Ponzi scheme? Have you been swindled and now don’t have enough cash to meet all your debts? Are you facing financial problems for any other reason? The Ira Smith Team can develop a restructuring plan for you.

Debt problems are stressful and confusing. The Ira Smith Trustee & Receiver Inc. Team understands the pain you are going through trying to stay alive and trying to support yourself and your family. We understand the pain and stress you are feeling thinking that you may just soon hit the wall.

Our debt settlement plan process can ease this stress. The Ira Smith Team has a great deal of experience in helping people avoid bankruptcy while resolving their debt problems. We understand your pain points. Call the Ira Smith Team today for your free consultation. We can end your pain and put you back on a healthy profitable path, Starting Over, Starting Now.