credit cards debt

Understanding Credit Cards Debt

It has recently been reported in the Canadian media that Canadians living in the GTA, including Vaughan, Markham, Toronto, Mississauga and York Region are now falling behind in both mortgage payments and other debt payments, including credit cards. If you’re losing sleep over credit cards debt and wondering if another cup of coffee can fix insolvency, you’re in good company. Let me tell you about one potential client who decided to pay down her debt by selling everything but the kitchen sink (that story ends with a suspiciously clean living room and a little more dignity than she expected).

Credit cards debt isn’t just numbers—it’s late-night stress, broken sleep, and more apologizing to your barista than you’d like. But if you’re buried in statements, you need more than the usual advice you’ve heard a dozen times. In this Brandon’s Blog, I’m being real to give you some breathing room.

Before we dive into solutions, let’s be clear on what we’re dealing with. Credit cards debt isn’t just those numbers on your monthly statement—it’s a financial reality that affects millions of Canadians every day.

Definition and Basics

Credit cards debt occurs when you carry a balance from month to month instead of paying off your entire statement balance. Here’s how it works: when you make purchases with your credit card and don’t pay the entire balance by the due date, the remaining amount becomes debt. The credit card company then charges interest on this balance, and if you only make minimum payments, that interest compounds monthly.

In Canada, the average credit card interest rate sits around 19-29% annually. That means if you owe $5,000 and only make minimum payments, you could end up paying thousands more in interest over time. The math is brutal, but understanding it is your first step toward taking control.

Impact on Credit Score

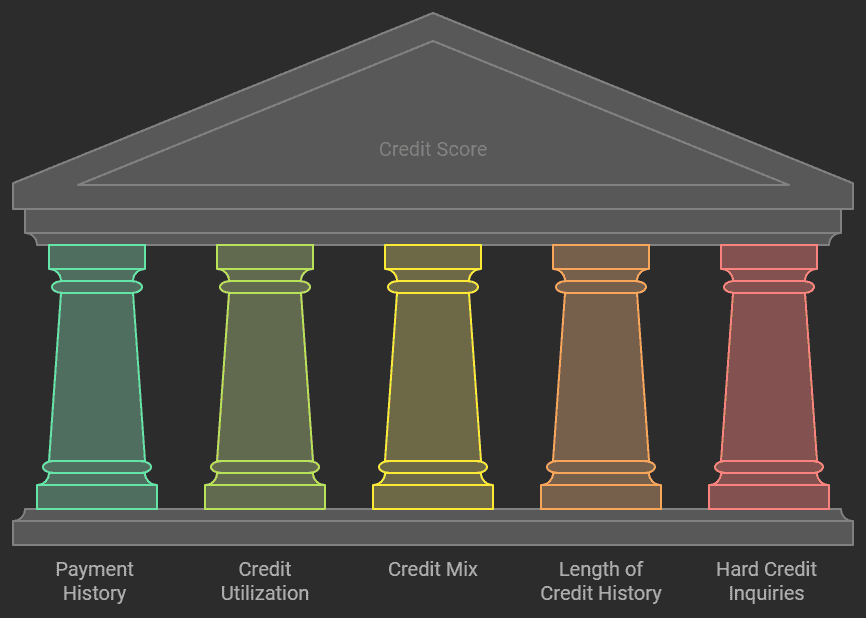

Your credit cards debt directly affects your credit score in several ways. Payment history makes up 35% of your credit score—the biggest factor. Missing payments or making late payments can drop your score significantly. But there’s another sneaky factor: credit utilization.

Credit utilization is how much of your available credit you’re using. If you have a $10,000 limit and owe $7,000, you’re using 70% of your available credit. Experts recommend keeping this below 30%, ideally under 10%. High utilization signals to lenders that you might be financially stretched, which can hurt your score even if you’re making payments on time.

A damaged credit score doesn’t just affect future credit cards—it can impact your ability to get a mortgage, car loan, or even rent an apartment. Some employers and insurance companies also check credit scores.

Legal Consequences: Wage Garnishment and Account Levies

Here’s where things get serious. If you stop making payments entirely, credit card companies won’t just send stern letters forever. In Canada, they can take legal action to collect what you owe.

After several months of non-payment, your account typically gets sent to collections. If collection efforts fail, the creditor can sue you for the debt. If they win (which they usually do), they can obtain a court judgment. With this judgment, they can:

- Garnish your wages: In Ontario, creditors can take up to 20% of your gross wages directly from your paycheck

- Freeze your bank accounts: They can obtain a court order to freeze funds in your bank accounts

- Place liens on property: In some cases, they can put a lien on your home or other assets

The good news? There are legal protections and exemptions. Certain types of income, like social assistance, employment insurance, and pensions, have some protection from garnishment. But don’t wait for it to get this far—there are always better options.

Causes of Credit Cards Debt

Understanding how you got here is crucial for making sure it doesn’t happen again. Let’s break down the main culprits behind credit card debt in Canada.

High Annual Percentage Rates (APR)

Canadian credit card interest rates are among the highest forms of consumer debt. While mortgage rates might be around 5-7%, credit cards typically charge 19-29% annually. Some store cards and cash advance rates can be even higher.

Here’s the kicker: credit card companies make most of their money from interest, not annual fees. They’re betting that you’ll carry a balance, and those high rates ensure they profit handsomely when you do. Even if you think you’ll pay it off quickly, life has a way of getting in the way.

Only Paying the Minimum

This is the credit card company’s favourite scenario. Minimum payments are typically calculated as a small percentage of your balance, often just 2-3%. On a $5,000 balance with a 20% interest rate, your minimum payment might be only $100.

But here’s the trap: most of that payment goes toward interest, not principal. You might pay $80 in interest and only $20 toward your actual debt. At this rate, it would take over 30 years to pay off that $5,000, and you’d pay more than $11,000 in total. The credit card companies designed it this way.

Poor Money Management

Let’s be honest,, without being judgmental, many Canadians never learned proper money management skills. Schools, until very recently, didn’t teach budgeting, and many families don’t discuss finances openly. You’re not alone if you’re figuring this out as you go.

Poor money management often looks like:

- Not tracking spending or having a budget

- Using credit cards for regular expenses without a payoff plan

- Not understanding how interest compounds

- Making financial decisions based on emotions rather than facts

- Treating available credit as available money

The good news? These are all learnable skills, and it’s never too late to start.

Unexpected Expenses

Sometimes credit card debt isn’t about poor planning—it’s about life throwing you curveballs. Car repairs, medical expenses, job loss, or family emergencies can force you to rely on credit cards for survival.

In Canada, many people don’t have adequate emergency savings. Statistics show that nearly half of Canadians are within $200 of not being able to pay their bills each month. When unexpected expenses hit, credit cards become the only option. While this might be necessary in the moment, it can quickly spiral into long-term debt problems.

Consequences of Credit Cards Debt

The impact of credit cards debt goes far beyond just owing money. It affects your entire financial life and, frankly, your overall well-being.

Financial Implications

The most obvious consequence is the financial cost. High interest rates mean you’re paying much more than the original purchase price. But the financial implications go deeper:

Opportunity Cost: Every dollar you pay in credit card interest is a dollar you can’t save, invest, or spend on things you need. If you’re paying $200 monthly in credit card interest, that’s $2,400 per year that could have gone toward building an emergency fund or saving for a down payment.

Reduced Borrowing Power: High credit card balances hurt your debt-to-income ratio, making it harder to qualify for mortgages, car loans, or other credit. Even if you do qualify, you might face higher interest rates because you’re seen as a higher risk.

Limited Financial Flexibility: When a large portion of your income goes to debt payments, you have less room to handle life’s ups and downs. A minor emergency can become a major crisis when you’re already stretched thin.

Compound Effect: Credit card debt can create a vicious cycle. High balances lead to high minimum payments, leaving less money for other expenses, which can lead to more credit card use, which increases balances and minimum payments.

Psychological and Physiological Impacts

Here’s what the financial industry doesn’t always talk about: debt stress is real, and it affects your health in measurable ways.

Mental Health Effects: Persistent worry about money can lead to anxiety and depression. Many Canadians report losing sleep over their finances. The constant stress of juggling payments, avoiding calls from creditors, and feeling trapped can take a serious toll on mental health.

Physical Health Impacts: Chronic financial stress doesn’t just stay in your head. It can cause:

- Headaches and muscle tension

- Digestive problems

- High blood pressure

- Weakened immune system

- Sleep disorders

Relationship Strain: Money problems are one of the leading causes of relationship conflicts and divorce in Canada. The stress of debt can affect how you interact with family and friends. Some people become withdrawn, while others become irritable or defensive about spending.

Self-Worth Issues: Many people tie their financial situation to their worth. Debt can lead to feelings of shame, failure, or inadequacy. This emotional burden can make it even harder to take the practical steps needed to address the debt.

Decision Fatigue: Constantly worrying about money and making difficult financial choices can exhaust your mental energy. This can lead to poor decision-making in other areas of life, creating a cycle where stress leads to more problems.

The important thing to remember is that these impacts are real and valid, but they’re also temporary. As you work toward solving your debt problems, you’ll likely notice improvements in these areas too. Your mental and physical health matter just as much as your financial health—they’re all connected.

Credit Cards Debt Confessions from Rock Bottom: Facing the Debt Monster

If you’re staring at your credit card statements, feeling like you’re drowning in debt with no cash in sight, you’re not alone. Canadians everywhere are feeling the squeeze—rising living costs, job uncertainty, and hefty mortgages and car loans have pushed many to the edge. The stress is real, and sleepless nights are a common occurrence. But here’s the truth: the first step out of this mess is financial honesty—with a healthy dose of tough love.

“Being honest with yourself is the bravest first step out of a debt spiral.” — Lesley-Anne Scorgie

Step One: Brutal Honesty About Your Debt

Before you can build any debt management strategy, you need a clear picture of where you stand. Grab whatever works—a spreadsheet, a napkin, your phone—and list every credit card balance, interest rate, and minimum payment. No skipping, no sugarcoating. This is your financial reality check. Research shows that self-assessment and goal-setting are the cornerstones of effective financial planning.

- List all debts (credit cards, loans, lines of credit)

- Record each interest rate, especially the high ones

- Note when the minimum payments are due

High-interest credit card debt can quietly drain your finances the fastest. Identifying which card is costing you the most is key—this is where your focus should go first.

Step Two: Ditch the Self-Blame, Start Planning

It’s easy to spiral into guilt or shame, but that won’t help you pay off a single dollar. Instead, channel that energy into actionable planning. Canadians’ confidence in repaying credit cards debt is slowly rising—45% now expect it will take six months or more to get out from under, down from 51% last year. That’s progress, and it starts with a plan.

Step Three: Pause All Non-Essential Spending

This is the tough part. Cutting out non-essential spending feels scary, but it’s a game-changer. Cancel subscriptions, skip takeout, and avoid impulse buys. Every dollar you save can go toward your minimum payments. Even small changes add up fast. If you’re worried about missing out, remember: this is temporary, and it pays off in the long run.

Step Four: Use Every Tool—Even Your Tax Refund

Over 70% of Canadians receive a tax refund. If you’re one of them, put that money straight toward your highest-interest debt. It’s a quick way to make a dent and boost your momentum. Research indicates that even a small windfall can help you break the cycle of minimum payments and mounting interest rates.

Real Talk: Stress Is Normal, But Action Is Powerful

Stress and sleeplessness are natural side effects of financial strain. Don’t beat yourself up. Instead, focus on what you can control: honest self-assessment, a clear debt management strategy, and a commitment to trimming expenses. Facing your debt monster head-on is tough, but it’s the only way forward. And remember, if you need help, there are professionals and programs ready to support you.

The Great Cash Hunt: Squeezing Pennies From Stone (and Facebook)

If you’re a Canadian consumer worried about your credit cards debt and wondering where on earth you’ll find extra income, you’re not alone. The good news? There are more ways to squeeze cash from your current situation than you might think—even if it feels like you’re wringing water from a stone.

Unconventional Ways to Boost Cash Flow

Let’s get creative. Research shows that Canadian debt advice often starts with side hustles and decluttering. Have you considered picking up extra shifts at work or dusting off an old side hustle? Babysitting, dog walking, house cleaning, or even personal training can add up quickly. And don’t forget about that tax refund—over 70% of Canadians are owed money by the CRA. Even if you’re late, file those taxes! That refund could be the cash lifeline you need.

- Extra shifts: Ask your employer for overtime or additional hours

- Side hustles: Babysitting, dog walking, or cleaning for neighbours

- Late tax filing: Don’t skip it—your tax refund might surprise you

- Collect owed money: Follow up on bonuses or debts friends still owe you

Declutter With Abandon

Here’s where things get interesting. If it’s collecting dust, it’s potential debt relief. Look around: that old bike, the bread maker you never use, or the stack of video games from 2012. Platforms like Kijiji and Facebook Marketplace are full of buyers. This potential client sold a rare ’90s bike for double what she paid—sometimes nostalgia pays off in real cash.

“Every forgotten gadget or outgrown coat is a tiny step out of debt.” — Lesley-Anne Scorgie

Don’t underestimate the power of decluttering. Not only does it free up space, but it can also give you a quick cash injection. Research indicates that selling possessions is one of the most common ways Canadians improve cash flow in a pinch.

Strategic Cuts: Kill Non-Essential Spending

Now’s the time to go full-on military with your budget. Cancel unused subscriptions and memberships. Grocery shop with a plan—no more wandering the aisles and tossing random snacks into your cart. Buy only what you need, and aim for zero food waste. If you’re renting or leasing, avoid renewing unless it’s necessary. Every dollar saved is a dollar that can go toward your debt.

- Subscriptions: Cut anything you don’t use weekly

- Groceries: Shop with a list, buy in bulk, and cook at home

- No new leases: Hold off on new car or apartment leases if you can

Remember, cutting recurring costs is more powerful than chasing random coupons. The goal is to redirect every spare dollar toward lowering your credit cards debt. As you chip away at your balances, you’ll start to see progress—and that’s the best motivation of all.

Avalanche, Not Snowball: Smarter Ways to Attack Credit Cards Debt

If you’re staring at a stack of credit card bills and feeling like you’re drowning, you’re not alone. Canadians everywhere are facing the same uphill battle, especially as interest rates stay higher and the cost of living squeezes every last dollar. But there’s a smarter way to dig out—one that doesn’t just chip away at your debt, but helps you save on interest and get ahead faster: the Avalanche Method.

Here’s the real talk: you must always make your minimum payments on every card. That’s non-negotiable. But if you can scrape together even a little extra, whether from a side gig, selling unused stuff, or cutting back on spending, throw every spare dollar at the card with the highest interest rate. That’s your financial enemy number one. This is the heart of the Avalanche Method, and it’s proven to save you more money than the popular “snowball” approach, which focuses on the smallest balance first.

Why does this work? Because interest rates on credit cards debt are brutal. By targeting the highest-rate balance, you slow the snowballing effect of compounding interest. Research shows that Canadians who stick to the Avalanche Method and stay ruthless about not adding new debt can see real progress in as little as 90 days. As Lesley-Anne Scorgie puts it:

“The avalanche method only works if you avoid new debt while attacking existing balances.”

That’s the catch. You have to be relentless. No new purchases, no “just this once” exceptions. If you’re serious about getting out of credit card chaos, every dollar counts—and every new charge sets you back.

But what if you’re still falling behind, even after cutting expenses and boosting your income? Don’t panic. This is when you pick up the phone and call your credit card companies. It might feel intimidating, but remember: they want to get paid. Explain your situation honestly and ask about options like:

- Lowering your interest rates

- Waiving late or over-limit fees

- Setting up a hardship plan

Sometimes, just asking is enough to get a break. And if you hear about debt consolidation or balance transfer offers, listen up. These strategies let you combine your debts—possibly even other loans—into a single payment with a lower interest rate. That means more of your money goes toward the principal, not just the interest. But be careful: applying for too many new credit products can ding your score, and missed payments might make it tough to qualify for the best rates.

If you’re stuck, consider a Debt Management Plan (DMP) through a non-profit credit counselling agency. Research indicates that DMPs can slash your interest rates—sometimes down to zero—and help you pay off debt faster. It’s not a magic fix, but it’s a lifeline for many Canadians feeling overwhelmed by credit card chaos.

Bottom line? The Avalanche Method, paired with honest communication and smart debt management strategies, gives you the best shot at breaking free from high-interest debt. Stay focused, stay ruthless, and remember: you’re not alone in this fight.

Last Stop: When DIY Doesn’t Cut It, Call the Credit Cards Debt Pros

Let’s be real—sometimes, no matter how hard you hustle, cut back, or negotiate, your debt just won’t budge. If you’ve spent 90 days throwing everything you’ve got at your credit cards debt and you’re still underwater, it’s time to consider a different approach. Don’t wait for disaster to strike. This is the moment to reach out for professional debt relief—and there’s no shame in that.

Here’s the truth: Licensed insolvency trustees are the debt pros. We’re not here to judge you or scold you for past mistakes. Instead, we offer expert, practical help tailored for Canadians facing tough financial realities. Research shows that specialized support from credit counselling agencies and insolvency trustees can make a world of difference when self-guided strategies just aren’t enough. They’ll walk you through your options, including the possibility of an Ontario consumer proposal—a formal arrangement that lets you pay back a portion of what you owe, and stopping those relentless collection calls in their tracks.

What’s a consumer proposal, exactly? Think of it as a structured alternative to bankruptcy, designed specifically for Canadians who need a lifeline. With a consumer proposal, you work with a licensed insolvency trustee to negotiate a manageable repayment plan with your creditors. This can mean lower monthly payments, frozen interest, and—best of all—peace of mind. It’s not a magic wand, but it’s a real, legal solution that can help you rebuild without the crushing stigma of bankruptcy.

Maybe you’re considering borrowing from family or friends to get by. If you go down this road, treat it like a real loan. Write out an agreement, set a clear repayment schedule, and stick to it. This isn’t just about protecting your relationships—it’s about building trust and accountability as you work toward debt relief.

One thing to keep in mind: if you’ve tried for a consolidation loan and been turned down, don’t keep reapplying in a panic. Each application can ding your credit score, making things even harder. Instead, focus on making progress for a few months, then try again if your situation improves.

Most importantly, know this: asking for expert help isn’t failure—it’s financial self-defence. As Lesley-Anne Scorgie puts it:

“Asking for expert help isn’t failure—it’s financial self-defence.”

So, if you’ve given it your all for 90 days and you’re still stuck, don’t let shame or fear hold you back. Connect with a licensed insolvency trustee or a reputable credit counselling agency. They’ll help you explore every option, from consumer proposals to debt management plans, and guide you toward a future where your money—and your life—are back under your control.

Credit Cards Debt: Conclusion

You’re not alone in this. There’s a path forward, and it starts with reaching out for the right kind of help. Take that step—you deserve it. If you’re a GTA resident dealing with overwhelming debt, don’t wait for your credit situation to get worse. As a licensed insolvency trustee serving Toronto, Mississauga, Brampton, Markham, and surrounding areas, I’m here to help you understand your options.

Free consultation available:

- No obligation to proceed

- Complete review of your debt and credit situation

- Clear explanation of how debt solutions affect your Equifax credit score

- Practical next steps you can take immediately

Remember: Your current financial situation doesn’t define your future. With the right help and information, you can overcome both debt challenges and credit score problems.

As a licensed insolvency trustee serving the Greater Toronto Area, I encourage consumers and business owners to view financial difficulties not as failures but as challenges that can be addressed with proper guidance. By understanding the warning signs of insolvency and seeking professional advice early, many people and businesses can find a path forward – whether through restructuring, strategic changes, or in some cases, an orderly wind-down that protects their future opportunities.

Remember: The earlier you seek help for company insolvency concerns, the more options you’ll have.

If you or someone you know is struggling with too much debt, remember that the financial restructuring process, while complex, offers viable solutions with the right guidance. As a licensed insolvency trustee serving the Greater Toronto Area, I help entrepreneurs understand their options and find a path forward during financial challenges.

At the Ira Smith Team, we understand the financial and emotional components of debt struggles. We’ve seen how traditional approaches often fall short in today’s economic environment, so we focus on modern debt relief options that can help you avoid bankruptcy while still achieving financial freedom.

The stress of financial challenges can be overwhelming. We take the time to understand your unique situation and develop customized strategies that address both your financial needs and emotional well-being. There’s no “one-size-fits-all” approach here—your financial solution should be as unique as the challenges you’re facing.

If any of this sounds familiar and you’re serious about finding a solution, reach out to the Ira Smith Trustee & Receiver Inc. team today for a free consultation. We’re committed to helping you or your company get back on the road to healthy, stress-free operations and recover from financial difficulties. Starting Over, Starting Now.

The information provided in this blog is intended for educational purposes only. It is not intended to constitute legal, financial, or professional advice. Readers are encouraged to seek professional advice regarding their specific situations. The content should not be relied upon as a substitute for professional guidance or consultation. The author, Ira Smith Trustee & Receiver Inc., and any contributors do not assume any liability for any loss or damage.