The Ira Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting. We hope that you and your family are safe and healthy.

If you would prefer to listen to the audio version of this financial literacy month 2020 Brandon’s Blog, please scroll to the very bottom and click on the podcast.

Financial literacy month 2020 introduction

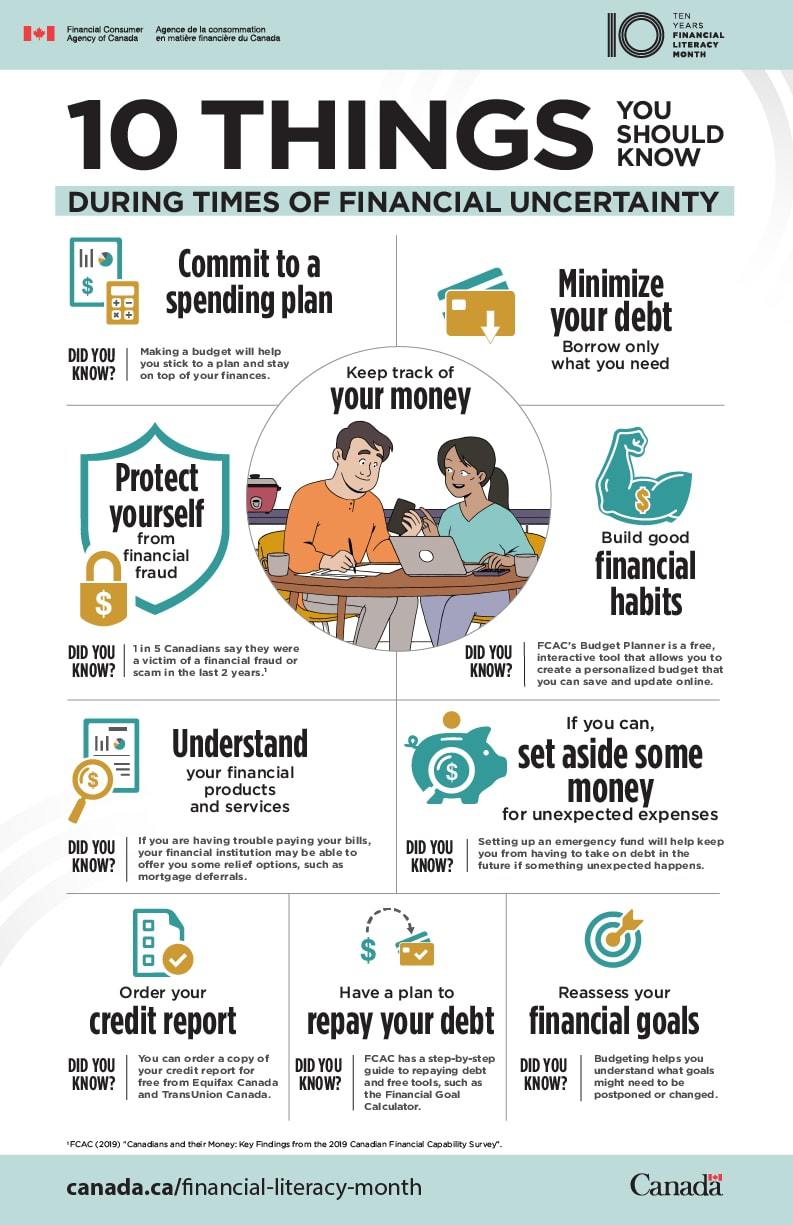

November is financial literacy month 2020. This is the 10th anniversary of financial literacy month in Canada.

Throughout financial literacy month, the Financial Consumer Agency of Canada (FCAC) engages with Canadians and interact with organizations from the private, public, and charitable sectors to help enhance the financial literacy of people.

For the entire month, organizations from throughout the country are urged to host seminars and share information intended at helping Canadians comprehend their finances and equipping them to manage their money and debt wisely.

In this Brandon’s Blog I discuss the importance of financial literacy and financial literacy month 2020.

Financial literacy month 2020: What is financial literacy?

Financial literacy in Canada means having the skills and knowledge to make educated choices regarding managing your money. Understanding fundamental financial ideas allow individuals to know how to browse the financial system. Individuals with financial literacy abilities make far better monetary choices and handle cash much better than those without these abilities.

Why is financial literacy month 2020 important?

Regular readers of Brandon’s Blog understand that one of the major reasons I discuss financial and insolvency issues is to assist to reinforce Canadian financial literacy. Especially, exactly how entrepreneurs, their business and people, in general, can much better handle their financial obligations.

The major benefit of financial literacy is that it equips us to make smart financial decisions. It supplies the understanding and skills we need to handle cash properly– budgeting, conserving, loaning, and investing. This suggests that we are far better furnished to reach our financial goals and attain financial security with a greater understanding of money matters.

As the economic market expands and becomes progressively more complicated, it is important that Canadians have the knowledge, abilities and self-confidence to make enlightened decisions about their money, budgeting and debt. Financial literacy is as important today as basic literacy.

Dedicating a financial literacy month 2020 to remind everyone how important financial literacy is, especially this year, is a great idea.

Financial literacy month 2020 content being shared

Canadian financial literacy month 2020 is dedicated to and therefore titled: Get Back to Basics! There is an entire calendar of events aimed to help you to update your studies in money matters.

This month, take some time to equip on your own and develop your very own understanding, abilities and confidence in handling money matters to ensure that you can make important financial choices. In these times we are experiencing, being better able to handle money matters is currently more crucial than ever before.

New content started on November 1st. The calendar of events include:

- Money Basics (Nov 1-7).

- Lay the foundation for smart financial planning with insights into subjects like financial investments, insurance coverage and retired life preparation Buying Basics (Nov 8-14).

- The fundamentals of exactly how to be smarter with your money, including details on savings accounts, and all things worldwide of basic personal money planning basics. A broad range of information on how to make smarter purchases – both large and little! Find out more regarding credit reports, consumer debt and mortgages. (Nov 15-21).

- Life Event Basics. Financial literacy hits you when major life events are involved. Check out the financial impact of events such as getting married, having children, losing a job and when illness strikes (Nov 22-27).

Financial literacy month 2020 aimed at giving you tips and tools to understand your finances

This year, financial literacy month aims to aid Canadians to find out just how to handle their funds in tough times. Keeping track of your money by making a spending plan will help a person to stick to a budget and remain on top of their finances.

Minimize debt: get only what you need. If you should borrow money, understand the cost of debt and have a plan to pay it back. CPA Canada has actually assembled resources to assist manage your financial resources and also provide you with the tools you require throughout this pandemic, during financial literacy month 2020 – and beyond.

Each November, Canadians celebrate financial literacy month. Urge your family members to discover new ways to become extra savvy with their money! Financial literacy month 2020 information even includes financial information for students and financial information for children. There is a plethora of information for all ages, including financial literacy for kids.

And finally, financial literacy month 2020 and the coronavirus

The Chartered Professional Accountants of Canada (CPA Canada) has just publicized its Canadian Finance Study 2020. According to this brand-new nationwide study, one-third of Canadians claim the tension associated with money management has increased due to the COVID-19 pandemic. This is understandable.

Survey participants state their income has been lowered as an outcome of the coronavirus. Thirty percent of participants report that in the early days of the COVID-19 lockdown, their savings rate decreased. However, 55% say that they are spending less as a result of the coronavirus. That is a good thing.

Recent information from Statistics Canada gives insight into the economic behaviour of Canadians during the COVID-19 pandemic. The second quarter of 2020 saw a spike in the savings rate to 28.2%. This is the highest savings rate since 1961!!

COVID-19 has had a clear effect on life worldwide. This further emphasizes the significance for individuals to take preventative measures in managing financial resources in the middle of the pandemic.

Some parents have the ability to keep their children at home to do online learning because they are too nervous about sending them to school. This is an opportunity for parents to add money management skills to your child’s education. The trick is to do projects with your children that teach lessons and skills that you must show them anyhow about money.

There are simple things you can do with very young children during financial literacy month 2020 and beyond, such as:

- Show them different denominations of coins and bills.

- Let the children sort through coins into like piles.

- Let them then count the coins and come up with a total of each pile. Right down each total and then have them add up all the individual amounts into one grand total.

- Use simple examples to teach your children how to make the change. This teaches them both arithmetic skills and financial skills. They need to know this to manage their lives, so why not do it this month?

I think all parents would feel very good about teaching these money skills to their children. This is much more preferable than leaving it up to the school and hoping that they properly understood the simpler money concepts they will use for their entire life.

Financial literacy month 2020 summary

I hope you have enjoyed this financial literary month 2020 Brandon’s Blog. Hopefully, you have better insight now into the fact that a sick insolvent company’s business can be saved by doing a sale of its assets to a healthy organization.

Do you or your company have too much debt? Are you or your company in need of financial restructuring? The financial restructuring process is complex. The Ira Smith Team understands how to do a complex restructuring. However, more importantly, we understand the needs of the entrepreneur or the person who has too much personal debt.

You are worried because you are facing significant financial challenges. It is not your fault that you are in this situation. You have been only shown the old ways that do not work anymore. The Ira Smith Team uses new modern ways to get you out of your debt troubles while avoiding bankruptcy. We can get you debt relief freedom.

The stress placed upon you is huge. We understand your pain points. We look at your entire situation and devise a strategy that is as unique as you and your problems; financial and emotional. The way we take the load off of your shoulders and devise a debt settlement plan, we know that we can help you.

We know that people facing financial problems need realistic lifeline. There is no “one solution fits all” approach with the Ira Smith Team.

That is why we can develop a restructuring process as unique as the financial problems and pain you are facing. If any of this sounds familiar to you and you are serious in finding a solution, contact the Ira Smith Trustee & Receiver Inc. team today.

Call us now for a free consultation.

We will get you or your company back on the road to healthy stress-free operations and recover from the pain points in your life, Starting Over, Starting Now.

The Ira Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting. We hope that you and your family are safe and healthy.

Financial literacy for kids: Introduction

Financial literacy for kids: Introduction