Ontario Estate Administration has become more complex. The recent Stewart Estate case shows why smart estate lawyers choose independent trustees. This protects clients and ensures smooth management of the deceased person’s estate.

Ontario Estate Administration: Role and Responsibilities of an Executor

In Ontario Estate Administration, the person who manages an estate is called an “estate trustee” (formerly called an “executor”). This role comes with important legal duties that many people don’t fully understand when they accept the position.

Gathering and Protecting Assets

The first job of an estate trustee is to find and secure all the deceased person’s property. This includes:

- Bank accounts and investments – Contact all financial institutions

- Real estate – Secure properties and arrange insurance

- Personal belongings – Inventory valuable items like jewelry, art, or collections

- Business interests – Identify any company shares or partnerships

- Digital assets – Access online accounts, cryptocurrencies, or digital files

Estate trustees must act quickly to protect these assets. Leaving a house empty without insurance or failing to secure bank accounts can lead to losses. If assets are lost due to poor protection, the trustee may be personally responsible for the value.

Applying for Probate

Most estates need a Certificate of Appointment (probate) from the Ontario Superior Court. This legal document proves the trustee has authority to act for the estate.

The probate process involves:

- Filing the original will with the court

- Completing detailed court forms about the estate’s value

- Paying probate fees (1.5% of estate value over $50,000)

- Notifying all beneficiaries and potential creditors

Getting probate can be a lengthy exercise, depending on the estate’s complexity and whether it is the extremely busy Toronto court or elsewhere in Ontario. During this time, many assets remain frozen, creating cash flow problems for the estate.

Managing Estate Finances

Estate trustees become responsible for all the deceased person’s financial debts. This includes:

Paying Debts and Bills

- Funeral expenses (priority payment)

- Outstanding credit card balances

- Utility bills and property taxes

- Medical expenses and care facility costs

Tax Responsibilities

- File the deceased’s final and any other outstanding income tax returns

- File estate tax returns if income is earned after death

- Pay all income taxes, capital gains taxes, and penalties

- Obtain CRA Clearance Certificate before final distributions

Investment Management Estate assets may need professional management, especially if the estate remains open for months or years. Poor investment decisions or leaving money in low-interest accounts can reduce the estate’s value.

Communicating with Beneficiaries

Estate trustees must keep beneficiaries informed throughout the process. This legal duty includes:

- Initial notification – Tell beneficiaries about their inheritance within a reasonable time

- Regular updates – Provide progress reports on estate administration

- Financial reporting – Share detailed accounts of income, expenses, and distributions

- Final accounting – Present complete financial records before closing the estate

Poor communication is one of the biggest sources of estate disputes. Beneficiaries who feel left in the dark often become suspicious and may challenge the trustee’s actions in court.

Ontario Estate Administration: Probate Process in Ontario

The probate process in Ontario can be complex and time-consuming. Understanding each step helps estate lawyers advise their clients about potential challenges and when professional trustee services might be needed.

Initiating the Process

The probate process begins when someone dies and leaves a will. The named estate trustee must decide if probate is required. Not all estates need probate, but most do if they include:

- Real estate owned solely by the deceased

- Bank accounts or investments over $25,000

- Assets that require court authority to transfer

Timeline Considerations Estate trustees should start the probate process within weeks of death. Delays can cause problems with:

- Asset protection and insurance coverage

- Bill payments and property maintenance

- Beneficiary expectations and family relationships

Required Documents Before starting, trustees need:

- Original will and any codicils

- Death certificate (multiple certified copies)

- Complete list of estate assets and their values

- List of all debts and liabilities

Evaluating Assets

Accurate asset valuation is crucial for probate fees and tax planning. Estate trustees must obtain current market values for all estate property.

Real Estate Valuation

- Hire qualified appraisers for property assessments

- Consider recent comparable sales in the area

- Account for any unique features or conditions

- Remember that tax assessments are usually lower than market value

Financial Assets

- Get statements showing balances on the date of death

- Value investment portfolios at market prices

- Include all registered accounts (RRSPs, TFSAs, pensions)

- Don’t forget about foreign assets or accounts

Personal Property

- Obtain professional appraisals for valuable items

- Include vehicles, jewelry, art, and collectibles

- Consider both insurance value and fair market value

- Document everything with photos and written descriptions

Filing the Application

The probate application goes to the Ontario Superior Court of Justice. This legal process involves several steps and strict requirements.

Court Forms and Fees

- Complete Form 74.4 (Application for Certificate of Appointment of Estate Trustee With A Will) or Form 74.20 (Application for Certificate of Appointment of Estate Trustee Without A Will)

- Pay probate fees: 1.5% of estate value over $50,000

- Submit required affidavits and supporting documents

- Provide notice to all beneficiaries and potential creditors

Review Process The court registrar reviews applications for:

- Completeness and accuracy of all forms

- Proper valuations of estate assets

- Valid signatures and witness requirements

- Compliance with notice requirements

Processing Time Simple estates typically take 6-8 weeks for probate approval. Complex estates with disputes or missing information can take several months.

Distributing Assets

Once probate is granted, estate trustees can begin distributing assets to beneficiaries. However, this must be done carefully to avoid personal liability.

Payment Priority Debts must be paid in this order:

- Funeral and burial expenses

- Estate administration costs

- Secured debts (mortgages, car loans)

- Unsecured debts (credit cards, personal loans)

- Gifts to beneficiaries

Timing Considerations

- Wait for the creditor claim period to expire (usually 6 months)

- Obtain CRA Clearance Certificate before final distributions

- Keep sufficient funds for unexpected expenses or claims

- Document all payments with detailed records

Distribution Methods Assets can be distributed as:

- Cash payments from estate bank accounts

- Transfer of specific property items

- Sale of assets with proceeds distributed

- A combination of cash and property transfers

Handling Taxes and Disputes

Tax obligations and family disputes are two of the biggest challenges estate trustees face. Both can create significant personal liability.

Tax Responsibilities Estate trustees must handle multiple tax filings:

- Final tax return for the deceased (due April 30 or 6 months after death)

- Estate tax returns for income earned after death

- Clearance certificate application to CRA

- Provincial tax obligations and filings

Common Tax Pitfalls

- Missing filing deadlines (results in penalties and interest)

- Incorrect valuation of assets for capital gains

- Failing to claim available deductions or credits

- Distributing assets before tax clearance

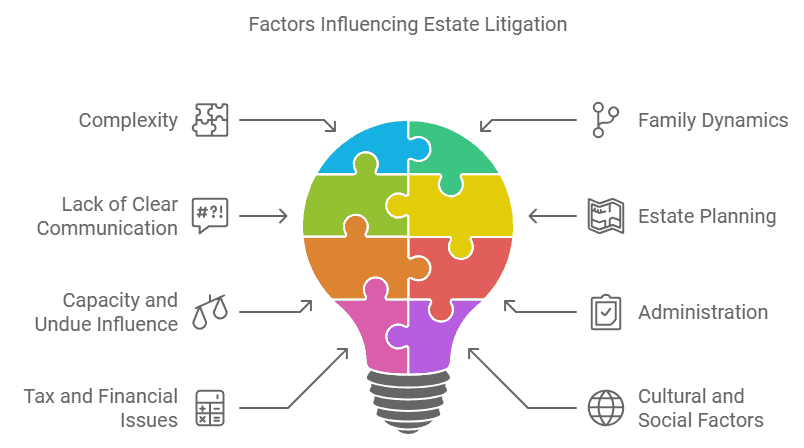

Managing Disputes Family conflicts often arise during estate administration:

- Beneficiaries questioning trustee decisions

- Disputes over asset valuations or distributions

- Challenges to will validity or interpretation

- Complaints about communication or transparency

When Disputes Escalate Estate litigation can be expensive and time-consuming. Common issues include:

- Beneficiaries seeking trustee removal

- Claims for financial compensation from trustee personally

- Court applications for direction on will interpretation

- Family members blocking estate administration

The Growing Problem: When Ontario Estate Administration Goes Wrong

Being an estate trustee in Ontario carries serious legal and financial risks. Many people don’t realize they can be personally liable for estate debts, tax bills, and administration mistakes. This personal liability can cost trustees thousands of dollars from their own pockets.

The Stewart Estate case, decided by the Ontario Superior Court of Justice and Court of Appeal for Ontario in 2025, perfectly illustrates these risks. What started as a simple will became a 30-year legal nightmare involving:

- $462,000 in unexpected tax bills

- Family property disputes

- Questions about trustee personal liability

- Massive legal costs

This case shows why estate lawyers across Ontario are increasingly recommending independent estate trustees for complex files.

The Stewart Estate: A Case Study in Estate Complications

The Original Plan

William Stewart wrote his will in 1989. His plan seemed straightforward:

- His wife Edith would receive a life interest in his property

- After Edith’s death, two sons would buy the family farms at fixed low prices

- One son’s mortgage would be forgiven

What Went Wrong

Life threw curveballs that William couldn’t predict:

The Mortgage Assignment (1994)

The estate transferred Robert’s mortgage to Edith. This simple administrative task later stopped the mortgage forgiveness William had planned.

Unexpected Death (2018)

Robert died before his mother Edith. Since Robert had no children, his wife Lynn inherited his rights to the farm.

Changed Circumstances

Edith lived 24.5 years after William died. During this time:

- The Winfield Farm value jumped from $90,000 to $1,120,000

- The Robert Farm increased from $50,000 to $617,500

- These price increases created a massive capital gains tax bill

The Tax Crisis

When Edith died, the estate faced a $462,000 tax bill. The estate didn’t have enough cash to pay. The farms meant as gifts to family might need to be sold to pay the Canada Revenue Agency (CRA).

Ontario Estate Administration Court Decisions: Key Lessons for Estate Lawyers

Ontario Superior Court Ruling (2025 ONSC 2275)

Gift Timing Matters

The court ruled that Robert’s gifts became legally his when William died, not when Edith died. This decision used the “presumption of early vesting” – a legal principle that gifts usually take effect when the will-maker dies.

Administrative Actions Have Consequences

The mortgage forgiveness failed because the mortgage was assigned to Edith. Once she owned it, William’s estate couldn’t forgive it. This shows how administrative choices can override a will’s original intentions.

Estates Must Pay Debts First

The court gave the estate trustee power to sell the farms at current market value, not the outdated prices in the will. The estate’s debts had priority over specific gifts to beneficiaries.

Personal Liability Remains Unclear

Most importantly for trustees, the court didn’t rule on whether the trustee was personally liable for tax decisions. This uncertainty creates ongoing risk for estate trustees.

Ontario Estate Administration: Court of Appeal Decision (2025 ONCA 575)

The Court of Appeal quickly denied the beneficiaries’ request to stop the farm sales. The court prioritized:

- Efficient estate administration

- Paying the estate’s debts

- Preventing CRA seizure of assets

This decision strongly supports estate trustees who make difficult but necessary decisions to protect estate solvency.

Ontario Estate Administration: The Hidden Risks Estate Trustees Face

Fiduciary Duties

Estate trustees must:

- Act in all beneficiaries’ best interests

- Avoid conflicts of interest

- Manage assets carefully

- Keep detailed records

- Communicate clearly with beneficiaries

Personal Liability Risks

Trustees can be personally responsible for:

- Asset mismanagement – Poor investment or property decisions

- Ignoring professional advice – Trying to handle complex issues alone

- Premature distributions – Paying beneficiaries before clearing all debts

- Tax mistakes – Missing deadlines or making poor tax decisions

- Poor communication – Failing to keep beneficiaries informed

- Unnecessary litigation – Pursuing costly legal battles

The CRA Clearance Certificate

Before making final distributions, trustees must obtain a Clearance Certificate from the CRA. Without this certificate, trustees remain personally liable for any unpaid estate taxes up to the value of assets they distributed.

Ontario Estate Administration: When Estate Lawyers Should Recommend Independent Trustees

High-Risk Situations

- Complex assets – Farms, businesses, or valuable real estate requiring specialized management

- Significant tax liabilities – Large estates with potential CRA issues

- Family conflicts – Beneficiaries already disagreeing or threatening litigation

- Outdated wills – Old documents that don’t reflect current circumstances

- Reluctant trustees – Named trustees who lack time, capacity, or willingness

- Conflict of interest – Trustees who are also major beneficiaries

Benefits of Independent Estate Trustees

Neutrality

Independent trustees have no family relationships or personal interests. They can make difficult decisions without bias or favouritism.

Professional Expertise

Estate trustees understand:

- Complex estate laws and tax laws and elections

- Asset valuation and management

- Legal procedures and deadlines

- Negotiation with government agencies

Risk Protection

Professional trustees assume personal liability, protecting your clients from financial risk.

Efficiency

Independent trustees can move estates forward even when beneficiaries disagree or try to delay administration.

Court Preference

Courts often prefer independent trustees in contentious matters, showing your proactive approach to conflict resolution.

Why Estate Lawyers Partner with Smith Estate Trustee Ontario

At Smith Estate Trustee Ontario, we understand the challenges estate lawyers face. Our experience includes:

- Many years of handling complex insolvency and estate matters

- Licensed by the Office of the Superintendent of Bankruptcy

- Extensive experience with high-value and contentious estates

- Strong relationships across Ontario

- Proven track record in complex tax and asset management situations

Our Approach

We work collaboratively with estate lawyers to:

- Assume trustee liability and responsibilities

- Handle day-to-day estate administration

- Manage beneficiary communications and conflicts

- Navigate complex tax situations

- Allow lawyers to focus on legal strategy and advice

Results for Your Practice

Partnering with us means:

- Protected clients who avoid personal liability

- Efficient estate administration even in complex cases

- Reduced stress on grieving family members

- More time for you to focus on legal work rather than administration

- Enhanced reputation for providing comprehensive solutions

Frequently Asked Questions About Independent Estate Trustees and Ontario Estate Administration

What is the difference between an estate trustee and an executor in Ontario Estate Administration?

In Ontario Estate Administration, “estate trustee” is the legal term that replaced “executor” in 1995. They mean the same thing – the person responsible for managing someone’s estate after death. Many people still use “executor,” but the courts and legal documents use “estate trustee.”

When should estate lawyers recommend an independent trustee instead of a family member?

Estate lawyers should consider recommending independent trustees when:

- The estate has complex assets like businesses or farms

- Family members are already fighting or threatening legal action

- The named trustee lacks time, skills, or willingness to serve

- There are significant tax liabilities or CRA issues

- The trustee is also a major beneficiary (creating a conflict of interest)

- The estate involves multiple provinces or countries

How much does an independent estate trustee cost?

Professional trustee fees in Ontario typically range from 2.5% to 5% of the estate’s total value. The exact fee depends on:

- Estate size and complexity

- Time required for administration

- Level of family conflict or disputes

- Special skills needed (tax planning, business management)

- Court involvement or litigation

While this seems expensive, it often saves money by avoiding costly mistakes, family litigation, and personal liability claims.

Can family members remove an independent trustee once appointed?

Removing an estate trustee requires a court application and valid legal grounds, such as:

- Breach of fiduciary duty

- Conflict of interest

- Inability to perform duties

- Loss of required qualifications

Simply disagreeing with trustee decisions is not enough. Courts prefer to keep qualified trustees in place rather than create delays and additional costs.

What happens if an estate trustee makes a mistake that costs the estate money?

Estate trustees can be personally liable for losses caused by their mistakes or negligence. Common examples include:

- Distributing assets before paying all debts and taxes

- Making poor investment decisions without proper advice

- Missing important tax deadlines or elections

- Failing to properly maintain estate property

- Not obtaining required court approvals

Professional trustees carry insurance to protect against these risks, while individual trustees usually don’t.

How long does estate administration typically take in Ontario Estate Administration?

Simple estates with few beneficiaries and no disputes typically take 12-18 months. Complex estates can take several years, especially if they involve:

- Business valuations and sales

- Real estate in multiple locations

- Family litigation or will challenges

- Tax disputes with CRA

- Foreign assets or beneficiaries

Independent trustees often complete administration faster because they work full-time on estate matters and have experience with complex issues.

What is a CRA Clearance Certificate, and why is it important?

A CRA Certificate of Clearance confirms that an estate has paid all its income taxes. Without this certificate, estate trustees remain personally liable for any unpaid taxes up to the value of assets they distributed to beneficiaries.

Getting clearance typically takes 4-6 months after filing all required tax returns. Many trustees make the mistake of distributing estate assets before receiving clearance, creating personal financial risk.

Can an independent trustee be appointed if the will names someone else?

Yes, courts can appoint independent trustees even when the will names family members. This happens when:

- The named trustee declines to serve

- The named trustee becomes incapacitated

- Conflicts of interest arise

- Family disputes make neutral administration necessary

- The estate becomes too complex for the named trustee

Estate lawyers can apply to court for trustee replacement or can work with named trustees to bring in professional assistance.

What qualifications should estate lawyers look for in an independent trustee?

Key qualifications include:

- Professional licensing (Licensed Insolvency Trustee, lawyer, or accountant)

- Specific estate administration experience

- Knowledge of Ontario estate administration and recognizing tax issues

- Professional liability insurance

- Bonding and regulatory oversight

- Experience with similar estate types and values

- Strong references from other lawyers and clients

How do independent trustees handle beneficiary disputes?

Professional trustees use several strategies to manage conflicts:

- Neutral communication

- – No family relationships or emotional involvement

- Clear documentation

- – Detailed records of all decisions and transactions

- Regular reporting

- – Frequent updates to keep everyone informed

- Professional mediation

- – Early intervention to resolve disputes

- Court applications

- – Seeking judicial direction when needed

Their neutrality often helps de-escalate family tensions and allows estates to move forward efficiently.

Ontario Estate Administration Conclusion: Protecting Your Clients and Your Practice

The Stewart Estate case demonstrates that even simple wills can become complex nightmares. Personal liability for estate trustees is real and growing. Smart estate lawyers now recommend independent trustees to protect clients and ensure smooth estate management.

Don’t wait for your clients to face a Stewart Estate situation. Consider recommending Smith Estate Trustee Ontario for your challenging files. We provide the expertise, neutrality, and risk protection your clients need.

Contact Smith Estate Trustee Ontario today. We can support your estate practice and protect your clients from hidden risks in estate administration.

About the Author

Brandon Smith is a Licensed Insolvency Trustee with years of experience handling complex financial and estate matters in Ontario. Smith Estate Trustee Ontario is part of Ira Smith Trustee & Receiver Inc. We provide independent estate trustee services to lawyers and families across Ontario

Contact Information

Smith Estate Trustee Ontario

Part of Ira Smith Trustee & Receiver Inc.

167 Applewood Crescent #6, Concord, ON L4K 4K

P: (647) 799-3312

E: brandon@irasmithinc.com

The information provided in this blog is intended for educational purposes only. It is not intended to constitute legal, financial, or professional advice. Readers are encouraged to seek professional advice regarding their specific situations. The content should not be relied upon as a substitute for professional guidance or consultation. The author, Ira Smith Trustee & Receiver Inc., and any contributors do not assume any liability for any loss or damage.

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.