Are you struggling with debt in Toronto, Vaughan, Newmarket, Mississauga, or anywhere else in the Greater Toronto Area? Your Equifax credit score might be telling a story you didn’t expect. As a licensed insolvency trustee serving the GTA, I’ve seen how credit score surprises can impact families when they need financial help most.

What is an Equifax Credit Score?

Your Equifax credit score is a three-digit number between 300 and 900 that represents your creditworthiness to Canadian lenders. Think of it as your financial report card—it tells banks, credit card companies, and other lenders how likely you are to pay back money you borrow.

Why Equifax Canada matters:

- One of the two major credit bureaus (along with TransUnion)

- Used by most major Canadian banks and lenders

- Influences your ability to get mortgages, car loans, and credit cards

- Affects the interest rates you’ll be offered

Understanding Equifax Credit Score Ranges

Here’s what your Equifax credit score means:

- 800-900 (Excellent): You’ll get the best rates and terms

- 720-799 (Very Good): Strong credit with good loan options

- 650-719 (Good): Average credit, decent loan terms available

- 560-649 (Fair): Below average, higher rates and fewer options

- 300-559 (Poor): Difficulty getting approved for credit

The reality for GTA residents: If you’re struggling with debt, your score might be in the fair or poor range. But here’s the shocking truth—sometimes even people with good financial habits face unexpected credit score problems.

The Shocking Truth About Equifax Credit Scores in Canada

Your Equifax credit score is more than just a number—it’s your financial passport in Canada. But what happens when that passport gets taken away without warning?

David Tregear from Victoria, BC, thought he was doing everything right. He paid his bills on time and lived debt-free for two years. Then he applied for a car loan and got rejected. When he checked his Equifax credit score, he couldn’t believe what he saw: ZERO. Not a low score—completely erased.

This isn’t a one-off story. It’s happening to Canadians across the country, including right here in the GTA.

How Your Equifax Credit Score Can Disappear (And Why It Matters)

Here’s what Equifax Canada doesn’t tell you: if you don’t use credit for about two years, they can reset your credit score to zero. No warning. No second chances. You become “unscorable.”

Why this matters for GTA residents:

- Many Toronto-area lenders use Equifax Canada as their primary credit bureau

- A missing Equifax credit score can block you from getting a mortgage, car loan, or even a credit card

- TransUnion (the other major credit bureau) doesn’t have this same policy

- Your financial options can disappear overnight

How to Access Your Equifax Credit Score

Online Access (Easiest Method):

- Visit Equifax.ca and create a free account

- Use the Equifax Canada mobile app for quick checks

- Get one free credit report per year, plus monthly score updates with paid plans

Other Access Methods:

- By phone: Call 1-800-465-7166

- By mail: Send a written request to Equifax Canada

- In-person: Visit Equifax Canada offices (limited locations)

For GTA residents: Online access is fastest, but if you’re dealing with serious debt issues, sometimes speaking to someone directly helps clarify your options.

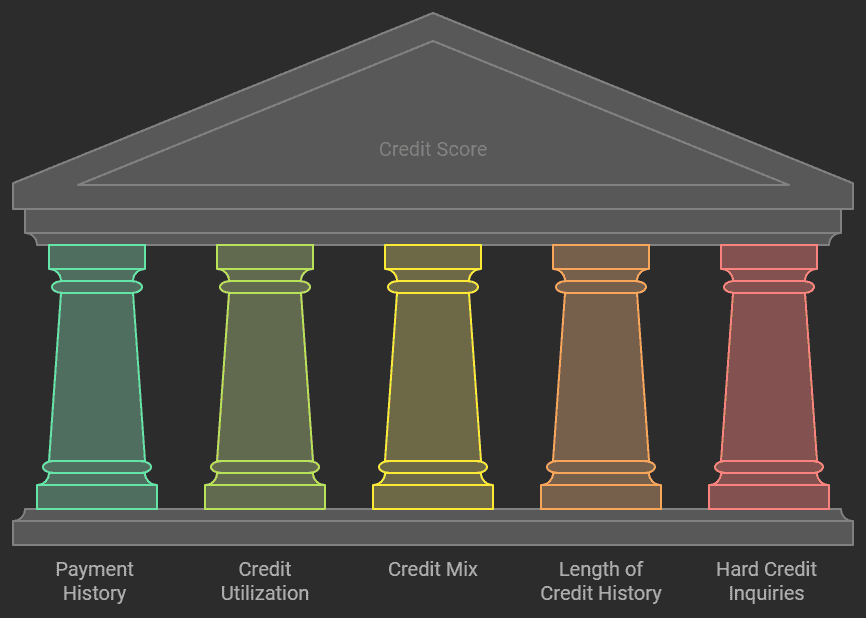

Factors That Influence Your Equifax Credit Score

Understanding what affects your score helps explain why it might be low, or why it disappeared entirely:

Payment History (35% of your score)

- Late payments hurt your score significantly

- Missing payments for 30+ days show up on your report

- Bankruptcy and consumer proposals appear here, too

Credit Utilization (30% of your score)

- How much of your available credit are you using

- Using more than 30% of your credit limit hurts your score

- Maxed-out credit cards are major red flags

Length of Credit History (15% of your score)

- How long have you had credit accounts

- Average age of all your accounts

- This is where the “unscorable” problem happens—no recent activity can reset your score

Types of Credit (10% of your score)

- A mix of credit cards, loans, and mortgages

- Shows you can handle different types of credit

Credit Inquiries (10% of your score)

- Hard inquiries from loan applications

- Too many inquiries in a short period hurt your score

The debt connection: When you’re overwhelmed by debt, multiple factors work against you—high utilization, missed payments, and desperate applications for more credit.

When Debt Problems Meet Credit Score Problems

As a licensed insolvency trustee in the GTA, I see clients facing double trouble: overwhelming debt AND damaged credit scores. Here’s what I’ve learned:

The Debt-Credit Score Cycle

When you’re drowning in debt, you might think avoiding credit is smart. But if your Equifax credit score gets reset to zero, rebuilding becomes nearly impossible. You can’t get approved for new credit to rebuild your score.

Comparing Equifax with TransUnion: Why It Matters

Key differences between Canada’s credit bureaus:

Scoring Models

- Equifax: Uses a 300-900 range, focuses heavily on payment history

- TransUnion: Also 300-900 range, but weighs factors slightly differently

- Your scores may differ between bureaus based on which lenders report to whom

The “Unscorable” Problem

- Equifax: Can reset your score to zero after about 2 years of inactivity

- TransUnion: Doesn’t have the same reset policy

- Result: You might be scoreable on one bureau but not the other

Lender Preferences

- Some GTA financial institutions prefer Equifax

- Others use TransUnion

- Many check both, but if one shows “unscorable,” you might be denied

Why this matters for debt relief: When considering consumer proposals or other debt solutions, we need to understand which bureau lenders will check and plan accordingly.

How to Get Your Free Equifax Credit Report

Step-by-Step Guide:

- Visit Equifax.ca and click “Get My Free Credit Report.”

- Verify your identity with personal information

- Answer security questions based on your credit history

- Review your report carefully for accuracy

- Download or print for your records

Protecting your information:

- Only use the official Equifax.ca website

- Never give your SIN over unsolicited phone calls

- Review reports regularly for identity theft signs

- Dispute errors immediately

Red flag for GTA residents: If you can’t access your report online or get “insufficient information” errors, you might be facing the “unscorable” problem.

Tools for Improving Your Equifax Credit Score

If You Can Still Get Credit:

- Pay bills on time: Set up automatic payments

- Lower credit utilization: Keep balances under 30% of limits

- Don’t close old accounts: Length of history matters

- Limit new applications: Each inquiry temporarily lowers your score

If You’re Struggling with Debt:

- Don’t ignore the problem: Credit scores recover faster than you think with proper help

- Consider debt consolidation: One payment instead of many

- Explore the consumer proposal process: Can eliminate up to 80% of debt while protecting assets

- Understand bankruptcy options: Sometimes it’s the fastest path to rebuilding credit

Premium Equifax Services

Equifax Complete™ Family Plan:

- Monthly credit score updates

- Credit monitoring and alerts

- Identity theft protection

- Costs around $25-35/month

Equifax ID Patrol™:

- Advanced identity monitoring

- Dark web scanning

- Recovery assistance if identity is stolen

My recommendation for debt-struggling families: Free credit reports are sufficient while you’re getting your finances back on track. Save the monthly fees for debt payments instead.

The Role of Credit History in Your Financial Recovery

How Long-Term Credit Behaviour Affects Your Options

Good credit history before debt problems:

- Makes you a better candidate for debt consolidation loans

- Can help negotiate better terms with creditors

- Provides more options for financial recovery

Poor credit history:

- Doesn’t disqualify you from debt relief options

- Consumer proposals work regardless of credit score

- Bankruptcy in Ontario provides fresh start opportunities

The “unscorable” situation:

- Creates unique challenges but doesn’t eliminate options

- May require secured credit cards to rebuild

- Licensed insolvency trustees can provide specific guidance

Real Stories from GTA Clients

I’ve helped families in Toronto, Vaughan, Newmarket, Scarborough, Brampton, and North York who discovered their Equifax credit score issues only when applying for debt consolidation loans. By then, their options were limited, but never eliminated.

Your Equifax Credit Score and Debt Solutions: What You Need to Know

Consumer Proposals and Your Credit Score

If you’re considering a consumer proposal in Ontario, here’s how it affects your Equifax credit score:

- A consumer proposal shows as an R7 rating on your Equifax credit report

- This stays on your report for 3 years after completion

- It’s better than bankruptcy (R9 rating), which stays for 6-7 years

- You keep your assets while getting debt relief

Bankruptcy and Credit Rebuilding

For some GTA residents, bankruptcy is the best fresh start option:

- First-time bankruptcy typically lasts 9 months in Ontario

- Your Equifax credit score will rebuild faster than you think

- We help clients understand the credit rebuilding process from day one

Protecting Your Equifax Credit Score: Practical Tips for GTA Residents

Monitor Your Score Regularly

- Check your Equifax credit score every few months

- Look for the “unscorable” warning before it’s too late

- Keep one small credit account active if you can manage it responsibly

Know Your Rights

- Equifax Canada must investigate disputes within 30 days

- You can add a consumer statement to your credit file

- Provincial and federal agencies can help with serious issues

Don’t Wait Until It’s Too Late

If you’re struggling with debt in Toronto, Vaughan, Mississauga, Markham, or anywhere in the GTA, don’t wait for credit problems to compound your debt problems.

Red Flags: When to Seek Help with Debt and Credit Issues

Contact a licensed insolvency trustee if you’re experiencing:

- Minimum payments that barely cover interest

- Using credit cards for basic expenses like groceries

- Considering payday loans or high-interest alternatives

- Credit applications are being denied due to debt levels

- Stress about money is affecting your daily life

How We Help GTA Residents Navigate Debt and Credit Challenges

As your local licensed insolvency trustee, I provide:

Free Consultations

- Review your complete financial situation

- Explain how debt solutions affect your Equifax credit score

- Discuss all options before you make any decisions

Personalized Debt Solutions

- Consumer proposals that can reduce debt by up to 80%

- Bankruptcy protection when it’s the right choice

- Credit rebuilding guidance throughout the process

Local GTA Knowledge

- Understanding of Ontario employment standards and exemptions

- Connections with local credit counselling services

- Knowledge of the GTA housing market impacts on financial decisions

The Bottom Line: Don’t Let Credit Score Confusion Add to Your Debt Stress

Your Equifax credit score is important, but it shouldn’t control your life. Whether your score is perfect, damaged, or mysteriously missing, there are always options for Canadians struggling with debt.

David Tregear’s story shows us that even people who think they’re doing everything right can face credit surprises. Don’t let debt problems and credit score issues compound each other.

Frequently Asked Questions About Equifax Credit Scores and Debt

How do debt problems relate to Equifax credit score problems?

Debt problems and low Equifax credit scores often form a difficult cycle. When overwhelmed by debt, individuals may miss payments (hurting payment history), use a high percentage of their available credit (increasing utilization), and potentially apply for more credit, leading to multiple inquiries. If, in an attempt to manage debt, someone stops using credit entirely for about two years, their Equifax score can reset to zero, making it almost impossible to rebuild credit through conventional means.

Can a consumer proposal improve my Equifax credit score?

A consumer proposal will initially lower your Equifax credit score, but it provides a clear path to rebuilding credit while eliminating unmanageable debt.

How long does it take to rebuild credit after bankruptcy?

Most clients see their Equifax credit score improve within 12-18 months of discharge with proper credit rebuilding strategies.

Should I check my Equifax credit score if I’m already in debt trouble?

Yes. Understanding your current credit situation helps determine the best debt relief strategy for your specific circumstances.

Can I get a mortgage in the GTA after a consumer proposal?

Many clients successfully obtain mortgages 1-2 years after completing a consumer proposal, often with better terms than they had while struggling with debt.

Take Action Today

If you’re a GTA resident dealing with overwhelming debt, don’t wait for your credit situation to get worse. As a licensed insolvency trustee serving Toronto, Mississauga, Brampton, Markham, and surrounding areas, I’m here to help you understand your options.

Free consultation available:

- No obligation to proceed

- Complete review of your debt and credit situation

- Clear explanation of how debt solutions affect your Equifax credit score

- Practical next steps you can take immediately

Remember: Your current financial situation doesn’t define your future. With the right help and information, you can overcome both debt challenges and credit score problems.

As a licensed insolvency trustee serving the Greater Toronto Area, I encourage consumers and business owners to view financial difficulties not as failures but as challenges that can be addressed with proper guidance. By understanding the warning signs of insolvency and seeking professional advice early, many people and businesses can find a path forward – whether through restructuring, strategic changes, or in some cases, an orderly wind-down that protects their future opportunities.

Remember: The earlier you seek help for company insolvency concerns, the more options you’ll have.

If you or someone you know is struggling with too much debt, remember that the financial restructuring process, while complex, offers viable solutions with the right guidance. As a licensed insolvency trustee serving the Greater Toronto Area, I help entrepreneurs understand their options and find a path forward during financial challenges.

At the Ira Smith Team, we understand the financial and emotional components of debt struggles. We’ve seen how traditional approaches often fall short in today’s economic environment, so we focus on modern debt relief options that can help you avoid bankruptcy while still achieving financial freedom.

The stress of financial challenges can be overwhelming. We take the time to understand your unique situation and develop customized strategies that address both your financial needs and emotional well-being. There’s no “one-size-fits-all” approach here—your financial solution should be as unique as the challenges you’re facing.

If any of this sounds familiar and you’re serious about finding a solution, reach out to the Ira Smith Trustee & Receiver Inc. team today for a free consultation. We’re committed to helping you or your company get back on the road to healthy, stress-free operations and recover from financial difficulties. Starting Over, Starting Now.

The information provided in this blog is intended for educational purposes only. It is not intended to constitute legal, financial, or professional advice. Readers are encouraged to seek professional advice regarding their specific situations. The content should not be relied upon as a substitute for professional guidance or consultation. The author, Ira Smith Trustee & Receiver Inc., and any contributors do not assume any liability for any loss or damage.